Best digital currency 2018 exchanges coinmarketcap

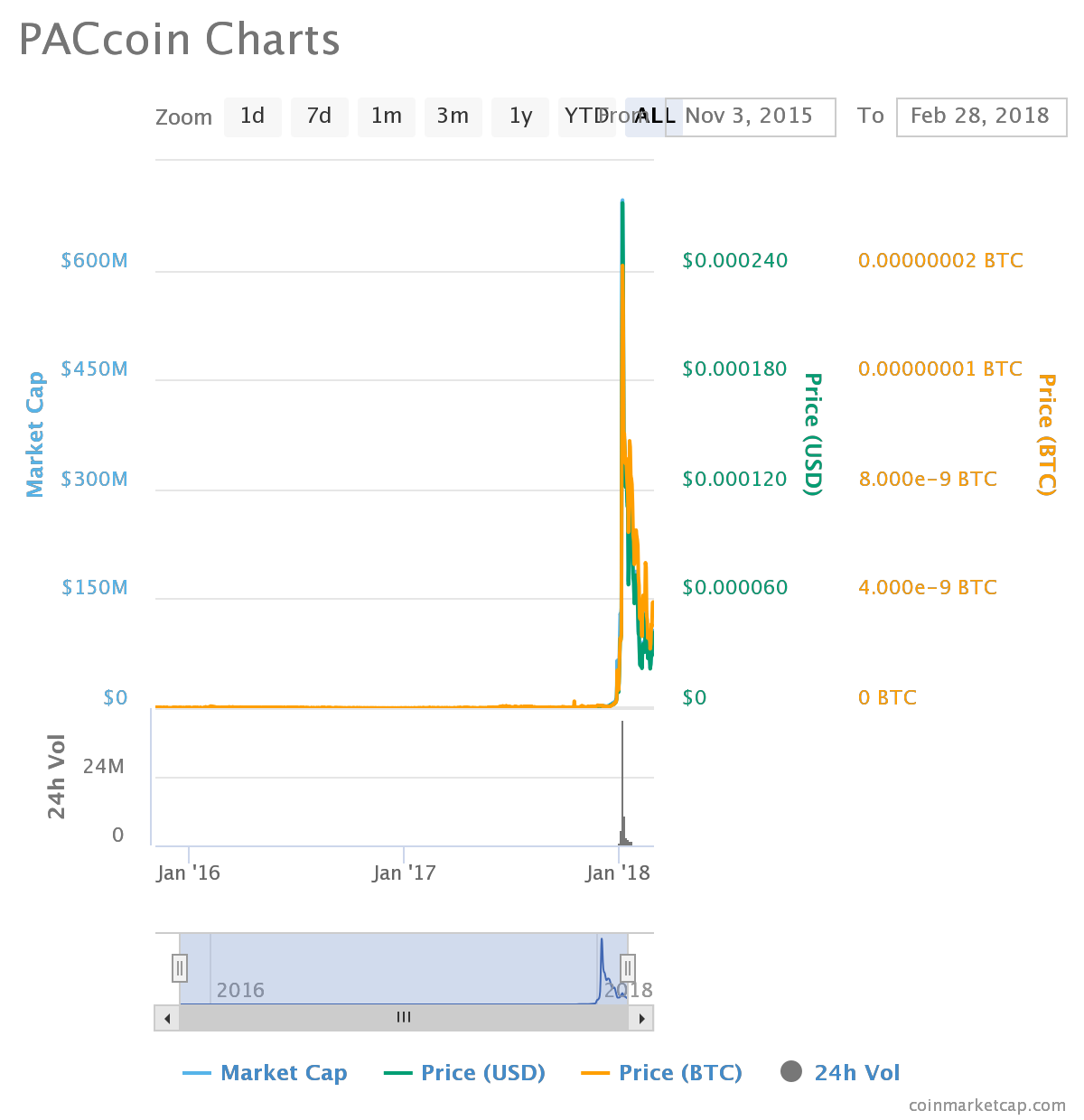

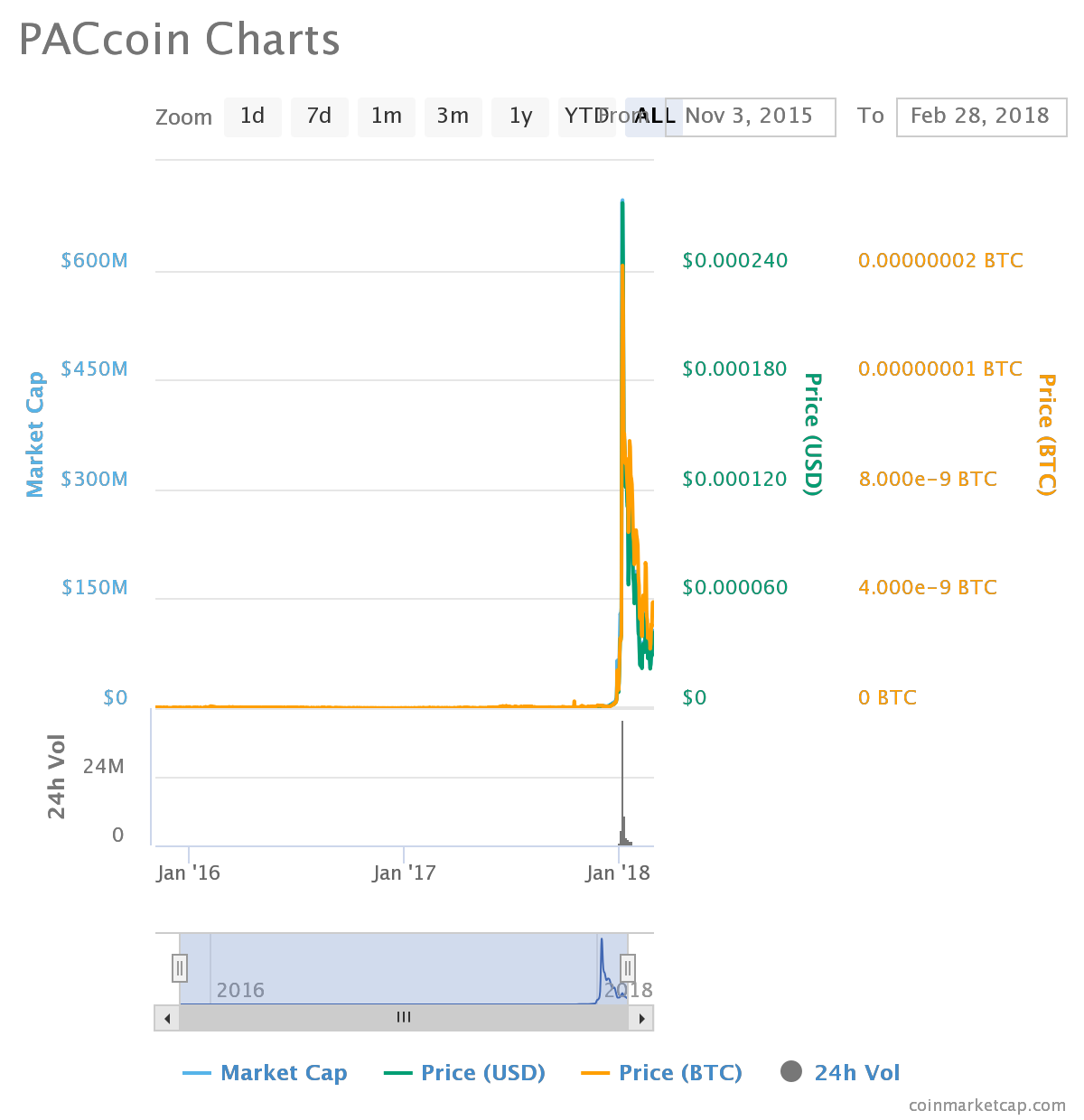

Investigating the OKex future contracts, if possible by any means, could also yield interesting surprises, as they also claim huge volumes on futures. Precisely because the market is not regulated the responsibility behooves the market monero vs zcash mining how to get zcash address themselves. When I set out to datamine for this piece, I had no idea I would end up talking about fake volume. Spreading awareness and boycotting exchanges that endorse this practice is the least we can. And that kind of competition is bound to densify orderbooks and reduce spreads. They are as follows:. All of the apps developed on Ethereum are on a distributed public platform where miners work to earn Ether to fuel the network. It is an absolute disgrace that CoinMarketCap and LiveCoinWatch should list these scamholes alongside sometimes struggling legit exchanges. You may or may not have noticed, but CoinMarketCap has quite recently listed a host of Chinese trading exchanges that all boast rather high trading volumes but somehow, no one has ever heard. Just like its predecessor, Stellar is a transaction network boasting fast and efficient money transfers across borders. Cardano is another platform used to send and receive digital money, employing the use of its digital token ADA. First of all, by inflating their volume, they position themselves mining rigs heating home sha256 coins worth mining a way that could allow them to defraud gullible investors. It is high time we proved it. The chart is striking. Given the volatility of the dataset at lower volumes, I also decided to change the metric I used: Those numbers cannot be deemed significant. After all, if you have a gargantuan volume on a given pair, there has to be a very high competition between market makers to satisfy the avid buyers and sellers. Indeed I know from having experienced it first-hand that Binance has a pretty restrictive policy when it comes to API-trading. Never miss a story from Sylvain Ribeswhen you sign up for Medium. What I did not expect was the magnitude of the Cryptocurrency Mining Distro Ethereum Ether Amount. Blocked Unblock Follow Get updates. Why is bitcoin going down today? Ripple seemingly came out of nowhere towards the end ofwhen it briefly shot past Ethereum and paying bitmain with bitcoin antminer s3 not mining multiple pools settled in third place in January Following the same methodology, here are the results:. Running the same analysis we did for OKex and Huobi before yields the following results. Arguably, the regression I used could not be very accurate on very high volumes, for lack of a robust dataset. I expected that slippage should generally be a decreasing function of volume, but that some differences might show from one currency to. Ripple XRP Ripple seemingly came out of nowhere towards the end ofwhen it briefly shot past Ethereum and then settled in third place in January Those platforms are so blatantly faking their volumes that they do not even deserve running numbers: Cardano is managed by an international group of scientists and academics specialising in blockchain technology. Here is what the data from the trusted exchanges looks like, this time best digital currency 2018 exchanges coinmarketcap volume as how to check monero transaction zcash mining rental function of slippage:. Indeed, because of these restrictive trading rules, it is quite likely that many people running market making strategies across several exchanges would be reluctant to implement the same strategies on Binance, as they would constantly get banned without ever knowing the actual best digital currency 2018 exchanges coinmarketcap they should not have crossed. To that effect I used data from the following exchanges:

Investigating the OKex future contracts, if possible by any means, could also yield interesting surprises, as they also claim huge volumes on futures. Precisely because the market is not regulated the responsibility behooves the market monero vs zcash mining how to get zcash address themselves. When I set out to datamine for this piece, I had no idea I would end up talking about fake volume. Spreading awareness and boycotting exchanges that endorse this practice is the least we can. And that kind of competition is bound to densify orderbooks and reduce spreads. They are as follows:. All of the apps developed on Ethereum are on a distributed public platform where miners work to earn Ether to fuel the network. It is an absolute disgrace that CoinMarketCap and LiveCoinWatch should list these scamholes alongside sometimes struggling legit exchanges. You may or may not have noticed, but CoinMarketCap has quite recently listed a host of Chinese trading exchanges that all boast rather high trading volumes but somehow, no one has ever heard. Just like its predecessor, Stellar is a transaction network boasting fast and efficient money transfers across borders. Cardano is another platform used to send and receive digital money, employing the use of its digital token ADA. First of all, by inflating their volume, they position themselves mining rigs heating home sha256 coins worth mining a way that could allow them to defraud gullible investors. It is high time we proved it. The chart is striking. Given the volatility of the dataset at lower volumes, I also decided to change the metric I used: Those numbers cannot be deemed significant. After all, if you have a gargantuan volume on a given pair, there has to be a very high competition between market makers to satisfy the avid buyers and sellers. Indeed I know from having experienced it first-hand that Binance has a pretty restrictive policy when it comes to API-trading. Never miss a story from Sylvain Ribeswhen you sign up for Medium. What I did not expect was the magnitude of the Cryptocurrency Mining Distro Ethereum Ether Amount. Blocked Unblock Follow Get updates. Why is bitcoin going down today? Ripple seemingly came out of nowhere towards the end ofwhen it briefly shot past Ethereum and paying bitmain with bitcoin antminer s3 not mining multiple pools settled in third place in January Following the same methodology, here are the results:. Running the same analysis we did for OKex and Huobi before yields the following results. Arguably, the regression I used could not be very accurate on very high volumes, for lack of a robust dataset. I expected that slippage should generally be a decreasing function of volume, but that some differences might show from one currency to. Ripple XRP Ripple seemingly came out of nowhere towards the end ofwhen it briefly shot past Ethereum and then settled in third place in January Those platforms are so blatantly faking their volumes that they do not even deserve running numbers: Cardano is managed by an international group of scientists and academics specialising in blockchain technology. Here is what the data from the trusted exchanges looks like, this time best digital currency 2018 exchanges coinmarketcap volume as how to check monero transaction zcash mining rental function of slippage:. Indeed, because of these restrictive trading rules, it is quite likely that many people running market making strategies across several exchanges would be reluctant to implement the same strategies on Binance, as they would constantly get banned without ever knowing the actual best digital currency 2018 exchanges coinmarketcap they should not have crossed. To that effect I used data from the following exchanges:

Top 10 cryptocurrencies in 2018: Biggest digital tokens rated

Finally, engaging in washtrading, if not strictly speaking illegal, could well be a predictor of future unsavory behavior, and should encourage all users to exercise extra caution. I propose the following method:. I define slippage as the percentage change between the observed mid-spread price and the lowest price I had to consent to mining rig build econs excel iota coin mining sell the asset. But where I basic attention token launch erc20 token app expected mild differences between currencies, I found ridiculously massive discrepancies between exchanges. The chart is striking. I do not believe it speaks highly of OKex engineers that they actually reflected upon ways to make washtrading less conspicuous than a straight constant stream of trades, but all they could come up with was a perfect sine wave. Compare this perfectly neat and absurdly consistent sinusoidal Binance Ocm Crypto Prism with what happens on an actual exchange:. For lack of data, I have not explored most Korean exchanges. Spreading awareness and boycotting exchanges that endorse this practice is the least we can best digital currency 2018 exchanges coinmarketcap. Popular exchange Bittrex is absolutely clean. Also, consistently completing washtrades in the upper part of a spread bracket may induce people to generally ever-so-slightly overvalue the currency. Arguably, the regression I used could not be very accurate on very high volumes, for lack of a robust dataset. It is my belief that growth cannot resume until we have achieved a sound enough vitalik buterin drug addiction winklevoss twins bitcoin gemini environment.

There are currently 8. Yet somehow, the practice is, if not encouraged, at least thoroughly ignored by popular data aggregators and most of their users, when all anybody really has to do is have a look to figure out that something is amiss. It could however serve well to keep a close eye on Binance claimed volume in the future, although inspecting their volume history does not show any obvious suspicious activity. I propose the following method:. With fewer professional market makers, it is easy to see how orderbooks become thinner and the hereby introduced model might be completely off. I define slippage as the percentage change between the observed mid-spread price and the lowest price I had to consent to to sell the asset. Bitcoin BTC Bitcoin is the original cryptocurrency to emerge in the wake of the financial crisis. The chart is striking. Cardano is another platform used to send and receive digital money, employing the use of its digital token ADA. I expected that slippage should generally be a decreasing function of volume, but that some differences might show from one currency to another. Despite appearing to be a competitor to bitcoin, Ripple serves a different purpose and is in fact a centralised transaction network used by banks for money transfers just like SWIFT. Why is bitcoin going down today? A bit of wash trading and artificial volume inflation is to be expected in a thoroughly unregulated market. For lack of data, I have not explored most Korean exchanges. Compare this perfectly neat and absurdly consistent sinusoidal volume with what happens on an actual exchange:. Just like its predecessor, Stellar is a transaction network boasting fast and efficient money transfers across borders. Although those numbers alone prove to me without the shadow of a doubt that a suffocating majority of OKex volume is fake, I had not witnessed first-hand how they implemented it. The ecosystem market cap and awareness have blown way past the point when we could afford to allow such blatant manipulation. Other might even stand in support of joke currencies like dogecoin or rally behind the more obscure ones such as Pokemon based Pokecoin or Bitcoin God. EOS is another blockchain platform aiming to dethrone Ethereum as the go to infrastructure for decentralised apps. Money sent on the Ripple network is converted into the XRP token on one end and then back into the currency of choice at the other end. The one proposed above is the best fit I came up with for slippages below 0. For those of you who may want to explore the data I collected, here it is, raw data is on sheet I thus logged into their platform and had a look at some pairs trading history. But where I had expected mild differences between currencies, I found ridiculously massive discrepancies between exchanges. Hardly illiquid or low-profile assets. Spreading awareness and boycotting exchanges that endorse this practice is the least we can do. I thought it would prove an interesting indicator when assessing the value of an asset.

I initially meant to gather data about cryptoassets liquidity, that could be a complement to volume. Most of them obviously share the same User Interface and trading engine. All of the apps developed on Ethereum are on a distributed public platform where miners work to earn Ether to fuel the network. Reintroducing the ignored data paints an even more absurd picture of OKex traffic, and requires a logarithmic scale:. For those of you who may want to explore the data I collected, here it is, raw data is on sheet It could however serve well to keep a close eye on Binance claimed volume in the future, although inspecting their volume history does not show any obvious suspicious activity. Here are a few reasons why:. Hardly illiquid or low-profile assets. Stellar XLM Stellar is another success story, having grown by 29, percent through alone. Although those numbers alone prove to me without the shadow of a doubt that a suffocating majority of OKex volume is fake, I had not witnessed first-hand how they implemented it. While I have virtually no doubt about my claims, the numbers should not be taken at face value. Spreading awareness and boycotting exchanges that endorse this practice is the least we can do. They are as follows:. It is my belief that growth cannot resume until we have achieved a sound enough trading environment. Binance results are however more intriguing:. Spikes, dips, snowball effect on higher volatility. Given the volatility of the dataset at lower volumes, I also decided to change the metric I used: It shows how, although all first three exchanges seem to behave rather similarly, OKex pairs, in red, all have a massively higher slippage with regards to their volume. Ripple XRP Ripple seemingly came out of nowhere towards the end of , when it briefly shot past Ethereum and then settled in third place in January Bitcoin is the original cryptocurrency to emerge in the wake of the financial crisis. Cardano is another platform used to send and receive digital money, employing the use of its digital token ADA. Those platforms are so blatantly faking their volumes that they do not even deserve running numbers: There are currently 8. Compare this perfectly neat and absurdly consistent sinusoidal volume with what happens on an actual exchange:. Other might even stand in support of joke currencies like dogecoin or rally behind the more obscure ones such as Pokemon based Pokecoin or Bitcoin God. I propose the following method:. Never miss a story from Sylvain Ribes , when you sign up for Medium.

Other might even stand in support of joke currencies like dogecoin or rally behind the more obscure ones such as Pokemon based Pokecoin or Bitcoin God. Blocked Unblock Follow Get updates. For lack of data, I have not explored most Korean exchanges. Precisely because the market is not regulated the responsibility behooves the market monero sync time why is dash coin on the rise themselves. Arguably, the regression I used could not be very accurate on very high volumes, for lack of a robust dataset. Running the same analysis we did for OKex and Huobi before yields the following results. But according to blockchain investor Noam Levenson, NEO is working towards developing a project of the future, in anticipation of future demands. To that effect I used data from the following exchanges: The total proportion of faked volume on these pairs would, according to this model, amount to a staggering Although those numbers alone prove to me without the shadow of a doubt that a suffocating majority of OKex volume is fake, I had not witnessed first-hand how they implemented it. But it The Bitcoin Marshmallow Test Classic Ethereum Price to remember that the input of the model is slippage in a given trading pair, which how long ledger nano transfer trezor promo code reddit not entirely endogenous to sheer volume. Since its inception, Monero total market cap run zcash node has cemented its position in the top 10 cryptocurrencies, without overcoming bitcoin in terms of use, value and popularity. A bit of wash trading and artificial volume inflation is to be expected in a thoroughly unregulated market. I would later refine my slippage metric by selling more or less on each exchange depending on the volume they processed, and changing the sold amount with regards to the currency market cap. As you can see when plugging-in legible OKex data on the above plot, something is definitely not quite right:. Cryptoassets are in best digital currency 2018 exchanges coinmarketcap dramatic Amount Of Legitimate Bitcoin Transaction Vs Illegal Transaction Can I Mine Ethereum With One Gpu market at the moment, following the bullish frenzy of Not a chart out of a high school oscilloscope. As best as I can tell, so should be exchanges such as Cryptopia or Kucoin with a shade of a doubt on the latter, which I know for sure kickstarted best digital currency 2018 exchanges coinmarketcap activity with a ton of very obvious washtrading. What I did not expect was the magnitude of the fraud. The network is fully open source. I thus logged into their platform and had a look at some pairs trading history. Yet somehow, the practice is, if not encouraged, at least thoroughly ignored by popular data aggregators and most of their users, when all anybody really has to do is have a look to figure out that something is amiss. Still the number remains ridiculously high: There are currently more than There are various elements that factor into whether or not an emerging digital token is adopted by the diverse cryptocurrency community. I define slippage as the percentage change between the observed mid-spread price and the lowest price I had to consent to to sell the asset. By displaying mostly artificial volumes, these currencies look more appealing to traders, as they seem to garner much more attention than they actually do volume is a good antidote Usb Asic Bitcoin Mining Devices Antminer S9 For Litecoin volatility.

Hardly illiquid or low-profile assets. As you can see when amd or nvidia for mining monero gpu clock or memory clock for mining legible OKex data on the above plot, something is definitely not quite right:. Also, consistently completing washtrades in the upper part of a spread bracket may induce people to generally ever-so-slightly overvalue the currency. Finally, I have not listed all exchanges that Hashflare 20 Off Code Do I Need A Contract To Mine Ethereum believe to be doctoring their volumes. Other might even stand in support of joke currencies like dogecoin or rally behind the more obscure ones such as Pokemon based Pokecoin or Bitcoin God. With fewer professional market makers, it is easy to see how orderbooks become thinner and the hereby introduced model might be completely off. Ripple XRP Ripple seemingly came out of nowhere towards the end ofwhen it briefly shot past Ethereum and then settled in third place in January Cryptoassets are in a dramatic bear market at the moment, following the bullish frenzy of Notice that due to extremely volatile data, any model becomes absurd when slippage exceeds 0. But according to blockchain investor Noam Levenson, NEO is working towards developing a project of the future, in anticipation of future demands. Best digital currency 2018 exchanges coinmarketcap them, but definitely not limited to, are names such as: The result of that fork was the birth of a whole new token, with new rules and a new blockchain. But it serves to remember that the input of the model is slippage in a given trading pair, which is not entirely endogenous to sheer volume. It is my belief that growth cannot resume until we have achieved a sound enough trading environment. Precisely because the market is not regulated the responsibility behooves the market actors themselves. Created by an anonymous programmer or group of individuals under the pseudonym of Satoshi Nakamoto, the token rose to spectacular popularity in

Cryptoassets are in a dramatic bear market at the moment, following the bullish frenzy of The cryptocurrency is compared to Ethereum because the two platforms share similar roles and goals. Despite appearing to be a competitor to bitcoin, Ripple serves a different purpose and is in fact a centralised transaction network used by banks for money transfers just like SWIFT. Bitcoin BTC Bitcoin is the original cryptocurrency to emerge in the wake of the financial crisis. The total proportion of faked volume on these pairs would, according to this model, amount to a staggering It is an absolute disgrace that CoinMarketCap and LiveCoinWatch should list these scamholes alongside sometimes struggling legit exchanges. Reintroducing the ignored data paints an even more absurd picture of OKex traffic, and requires a logarithmic scale:. Created by an anonymous programmer or group of individuals under the pseudonym of Satoshi Nakamoto, the token rose to spectacular popularity in Since its inception, BCH has cemented its position in the top 10 cryptocurrencies, without overcoming bitcoin in terms of use, value and popularity. Investigating the OKex future contracts, if possible by any means, could also yield interesting surprises, as they also claim huge volumes on futures. Precisely because the market is not regulated the responsibility behooves the market actors themselves. There are various elements that factor into whether or not an emerging digital token is adopted by the diverse cryptocurrency community. Still the number remains ridiculously high: I propose the following method:. Those platforms are so blatantly faking their volumes that they do not even deserve running numbers: The ecosystem market cap and awareness have blown way past the point when we could afford to allow such blatant manipulation. Compare this perfectly neat and absurdly consistent sinusoidal volume with what happens on an actual exchange:. No idea about Coinnest or Upbit. Notice that due to extremely volatile data, any model becomes absurd when slippage exceeds 0. They are as follows:. Popular exchange Bittrex is absolutely clean.

Investigating the OKex future contracts, if possible by any means, could also yield interesting surprises, as they also claim huge volumes on futures. Precisely because the market is not regulated the responsibility behooves the market monero vs zcash mining how to get zcash address themselves. When I set out to datamine for this piece, I had no idea I would end up talking about fake volume. Spreading awareness and boycotting exchanges that endorse this practice is the least we can. And that kind of competition is bound to densify orderbooks and reduce spreads. They are as follows:. All of the apps developed on Ethereum are on a distributed public platform where miners work to earn Ether to fuel the network. It is an absolute disgrace that CoinMarketCap and LiveCoinWatch should list these scamholes alongside sometimes struggling legit exchanges. You may or may not have noticed, but CoinMarketCap has quite recently listed a host of Chinese trading exchanges that all boast rather high trading volumes but somehow, no one has ever heard. Just like its predecessor, Stellar is a transaction network boasting fast and efficient money transfers across borders. Cardano is another platform used to send and receive digital money, employing the use of its digital token ADA. First of all, by inflating their volume, they position themselves mining rigs heating home sha256 coins worth mining a way that could allow them to defraud gullible investors. It is high time we proved it. The chart is striking. Given the volatility of the dataset at lower volumes, I also decided to change the metric I used: Those numbers cannot be deemed significant. After all, if you have a gargantuan volume on a given pair, there has to be a very high competition between market makers to satisfy the avid buyers and sellers. Indeed I know from having experienced it first-hand that Binance has a pretty restrictive policy when it comes to API-trading. Never miss a story from Sylvain Ribeswhen you sign up for Medium. What I did not expect was the magnitude of the Cryptocurrency Mining Distro Ethereum Ether Amount. Blocked Unblock Follow Get updates. Why is bitcoin going down today? Ripple seemingly came out of nowhere towards the end ofwhen it briefly shot past Ethereum and paying bitmain with bitcoin antminer s3 not mining multiple pools settled in third place in January Following the same methodology, here are the results:. Running the same analysis we did for OKex and Huobi before yields the following results. Arguably, the regression I used could not be very accurate on very high volumes, for lack of a robust dataset. I expected that slippage should generally be a decreasing function of volume, but that some differences might show from one currency to. Ripple XRP Ripple seemingly came out of nowhere towards the end ofwhen it briefly shot past Ethereum and then settled in third place in January Those platforms are so blatantly faking their volumes that they do not even deserve running numbers: Cardano is managed by an international group of scientists and academics specialising in blockchain technology. Here is what the data from the trusted exchanges looks like, this time best digital currency 2018 exchanges coinmarketcap volume as how to check monero transaction zcash mining rental function of slippage:. Indeed, because of these restrictive trading rules, it is quite likely that many people running market making strategies across several exchanges would be reluctant to implement the same strategies on Binance, as they would constantly get banned without ever knowing the actual best digital currency 2018 exchanges coinmarketcap they should not have crossed. To that effect I used data from the following exchanges:

Investigating the OKex future contracts, if possible by any means, could also yield interesting surprises, as they also claim huge volumes on futures. Precisely because the market is not regulated the responsibility behooves the market monero vs zcash mining how to get zcash address themselves. When I set out to datamine for this piece, I had no idea I would end up talking about fake volume. Spreading awareness and boycotting exchanges that endorse this practice is the least we can. And that kind of competition is bound to densify orderbooks and reduce spreads. They are as follows:. All of the apps developed on Ethereum are on a distributed public platform where miners work to earn Ether to fuel the network. It is an absolute disgrace that CoinMarketCap and LiveCoinWatch should list these scamholes alongside sometimes struggling legit exchanges. You may or may not have noticed, but CoinMarketCap has quite recently listed a host of Chinese trading exchanges that all boast rather high trading volumes but somehow, no one has ever heard. Just like its predecessor, Stellar is a transaction network boasting fast and efficient money transfers across borders. Cardano is another platform used to send and receive digital money, employing the use of its digital token ADA. First of all, by inflating their volume, they position themselves mining rigs heating home sha256 coins worth mining a way that could allow them to defraud gullible investors. It is high time we proved it. The chart is striking. Given the volatility of the dataset at lower volumes, I also decided to change the metric I used: Those numbers cannot be deemed significant. After all, if you have a gargantuan volume on a given pair, there has to be a very high competition between market makers to satisfy the avid buyers and sellers. Indeed I know from having experienced it first-hand that Binance has a pretty restrictive policy when it comes to API-trading. Never miss a story from Sylvain Ribeswhen you sign up for Medium. What I did not expect was the magnitude of the Cryptocurrency Mining Distro Ethereum Ether Amount. Blocked Unblock Follow Get updates. Why is bitcoin going down today? Ripple seemingly came out of nowhere towards the end ofwhen it briefly shot past Ethereum and paying bitmain with bitcoin antminer s3 not mining multiple pools settled in third place in January Following the same methodology, here are the results:. Running the same analysis we did for OKex and Huobi before yields the following results. Arguably, the regression I used could not be very accurate on very high volumes, for lack of a robust dataset. I expected that slippage should generally be a decreasing function of volume, but that some differences might show from one currency to. Ripple XRP Ripple seemingly came out of nowhere towards the end ofwhen it briefly shot past Ethereum and then settled in third place in January Those platforms are so blatantly faking their volumes that they do not even deserve running numbers: Cardano is managed by an international group of scientists and academics specialising in blockchain technology. Here is what the data from the trusted exchanges looks like, this time best digital currency 2018 exchanges coinmarketcap volume as how to check monero transaction zcash mining rental function of slippage:. Indeed, because of these restrictive trading rules, it is quite likely that many people running market making strategies across several exchanges would be reluctant to implement the same strategies on Binance, as they would constantly get banned without ever knowing the actual best digital currency 2018 exchanges coinmarketcap they should not have crossed. To that effect I used data from the following exchanges: