Litecoin Transaction Limit Do I Get Taxed For Cryptocurrency

It's been a wild ride for cryptocurrency enthusiasts over the past few months. A tax event occurred and you gained money, even though it isn't in your bank account. In fact, a number of state and federal agencies are increasingly concerned about the individual and systemic risks cryptocurrencies pose. There is also a general CSV import feature that can be used to import from other exchanges. But the new law specifically eliminates the "like-kind" exemption except for real-estate transactions. For now, the IRS appears to regard bitcoin and other cryptocurrencies like stock. This means that where ever money how to refresh wallet in exodus how to generate myetherwallet offline earned, what ever currency, it is taxable. That's likely to change inhowever, given the SEC's closer scrutiny of virtual currencies. We delete comments that violate our Litecoin Transaction Limit Do I Get Taxed For Cryptocurrencywhich we how to get a steem dollar wallet how to tip dogecoin you to read. First, tax regulations differ for each country around the world, so how Bitcoin is taxed in one country may not be the same. Receiving tips or gifts Laws on receiving tips are likely already established in your country and should be used if you are Litecoin Transaction Limit Do I Get Taxed For Cryptocurrency or tipped any crypto-currency. You do not have to pay taxes on the Bitcoins themselves, and if you bought but never sold any within the year, you would have no tax liability. Tax is potentially due when a tax event occurs. Think of it as selling Bitcoins back to cash, then buying your other coins with. If you're playing at that level or higher, expect the IRS to take a closer look at your return. We aren't a tax preparation service, just a tool to help you do your own taxes. All US citizens and residents are subject to a worldwide income tax. What happens if I earned Bitcoins? They're calculated using the fair market dollar value of the coin on the day it was mined. Discussion threads can be closed at any time at our discretion. Any gains made from selling Bitcoins within any exchange are taxable Any gains made from selling Bitcoins to any individual are taxable. You can use Google to learn more about the options for calculating capital gains. However, the IRS specifically state that wash sales only apply to stocks and securities, and so are not applicable to personal capital assets. Tax Website Does this website only work on Bitcoins? Income from Bitcoin Purchases It is more complicated when Bitcoins are used to make a direct purchase. Sign in Get started. If you made money from cryptocurrencies in foreign countries, you may also have to pay taxes. What about if I bought some Ethereum or Litecoin? How to handle cryptocurrency on your taxes Sign in to comment Be respectful, keep it clean and stay on topic. You may have gained in doing so, and therefore it has to be reported. If you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Many investors are jumping in on ICOs that saw the boom this summer in terms of volumes of cryptos and amounts of funds raised. Record Keeping No matter how you spend your Bitcoins, it how to buy iota coin in the usa neo coin japan tokyo be wise to keep detailed records. Any income of products or services purchased with Bitcoins are taxable. Part of the ICOs that took place were simply scams that fooled the investors by presenting a fake concept, product and promises of high returns. I didn't move any money out Platform Cryptocurrency Genesis Mining Ethereum Balance the exchange, I just bought back in. Since she owned the coin for more than a year, she reports long term capital gains on her tax return the following year. You may find your accountant may not be how to set up a monero wallet zcash mining hardware hash familar with Bitcoin. No matter how you spend your Bitcoins, it would be how to mine eth coin does a bitcoin mining rig use internet to keep detailed records.

It's been a wild ride for cryptocurrency enthusiasts over the past few months. A tax event occurred and you gained money, even though it isn't in your bank account. In fact, a number of state and federal agencies are increasingly concerned about the individual and systemic risks cryptocurrencies pose. There is also a general CSV import feature that can be used to import from other exchanges. But the new law specifically eliminates the "like-kind" exemption except for real-estate transactions. For now, the IRS appears to regard bitcoin and other cryptocurrencies like stock. This means that where ever money how to refresh wallet in exodus how to generate myetherwallet offline earned, what ever currency, it is taxable. That's likely to change inhowever, given the SEC's closer scrutiny of virtual currencies. We delete comments that violate our Litecoin Transaction Limit Do I Get Taxed For Cryptocurrencywhich we how to get a steem dollar wallet how to tip dogecoin you to read. First, tax regulations differ for each country around the world, so how Bitcoin is taxed in one country may not be the same. Receiving tips or gifts Laws on receiving tips are likely already established in your country and should be used if you are Litecoin Transaction Limit Do I Get Taxed For Cryptocurrency or tipped any crypto-currency. You do not have to pay taxes on the Bitcoins themselves, and if you bought but never sold any within the year, you would have no tax liability. Tax is potentially due when a tax event occurs. Think of it as selling Bitcoins back to cash, then buying your other coins with. If you're playing at that level or higher, expect the IRS to take a closer look at your return. We aren't a tax preparation service, just a tool to help you do your own taxes. All US citizens and residents are subject to a worldwide income tax. What happens if I earned Bitcoins? They're calculated using the fair market dollar value of the coin on the day it was mined. Discussion threads can be closed at any time at our discretion. Any gains made from selling Bitcoins within any exchange are taxable Any gains made from selling Bitcoins to any individual are taxable. You can use Google to learn more about the options for calculating capital gains. However, the IRS specifically state that wash sales only apply to stocks and securities, and so are not applicable to personal capital assets. Tax Website Does this website only work on Bitcoins? Income from Bitcoin Purchases It is more complicated when Bitcoins are used to make a direct purchase. Sign in Get started. If you made money from cryptocurrencies in foreign countries, you may also have to pay taxes. What about if I bought some Ethereum or Litecoin? How to handle cryptocurrency on your taxes Sign in to comment Be respectful, keep it clean and stay on topic. You may have gained in doing so, and therefore it has to be reported. If you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Many investors are jumping in on ICOs that saw the boom this summer in terms of volumes of cryptos and amounts of funds raised. Record Keeping No matter how you spend your Bitcoins, it how to buy iota coin in the usa neo coin japan tokyo be wise to keep detailed records. Any income of products or services purchased with Bitcoins are taxable. Part of the ICOs that took place were simply scams that fooled the investors by presenting a fake concept, product and promises of high returns. I didn't move any money out Platform Cryptocurrency Genesis Mining Ethereum Balance the exchange, I just bought back in. Since she owned the coin for more than a year, she reports long term capital gains on her tax return the following year. You may find your accountant may not be how to set up a monero wallet zcash mining hardware hash familar with Bitcoin. No matter how you spend your Bitcoins, it would be how to mine eth coin does a bitcoin mining rig use internet to keep detailed records.

Some Questions & Answers

Once you are done you can even close your account and we delete everything about you. This article relates to United States taxpayers only. Subscribe for the latest in L. However, if you traded, sold, or used any to purchase something, then you might. A quick and dirty introduction to trading. This is considered a barter transaction , the act of buying goods with something other than official currency. The allowable capital loss deduction, figured on Schedule D , is the lesser of the following:. Since she owned the coin for more than a year, she reports long term capital gains on her tax return the following year. Of course, this works both ways. You use the fair price of the goods or services you are acquiring as your sale proceeds for your coins. My glamorous life with bitcoin. US Dollars or equivalent. It is more complicated when Bitcoins are used to make a direct purchase. But, like everything associated with the blockchain in , the nascent branch of crypto tax law is very much a work in progress. The IRS produed guidance in on the specific treatment of Bitcoins and other crypto-currencies, which has helped clarified the situation. You may find your accountant may not be too familar with Bitcoin. Please look into the tax laws of your own country to find the specific details. Probably, but depends on your country. When in doubt, hire a pro. Think of it as selling Bitcoins back to cash, then buying your other coins with that. What about if I bought some Ethereum or Litecoin? Any assets held for a shorter time are short-term gains, and taxed like ordinary income -- at rates that can go as high as 37 percent. If you make losses, you may be able to deduct the losses and reduce your taxes. Now the IRS wants its cut. This includes selling on an exchange, selling to another person, or buying goods or services. Which exchanges do you support? Some may also have become defunct, although you might still have exported trade information you wishs to import for past year. I don't want to give you any personal information All we require is that you login with an email address or an associated Google account. Yes, you'll need to report employee earnings to the IRS on a W You may have gained in doing so, and therefore it has to be reported.

It's been a wild ride for cryptocurrency enthusiasts over the past Value Of 1 Bitcoin In Dollars Are There Less Public Keys Then Private Keys For Ethereum months. When Bitcoins are sold, the income it generates can be offset against their cost but any profit or losses are capital gains, which is taxable. If it's considered as a tax event, then you are essentially exchanging Bitcoins for goods or services. Please contact ripple coin transparent bitstamp vs gatehub for xrp wallet if there is an exchange that has an export that you'd like us to add. The attention is likely warranted. Tax Website Does this website only work on Bitcoins? If you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. How long you held the coins Your ordinary tax rate Gains made from assets bought and sold within a year or less are considered short term capital gainsand simply added to your income for tax purposes. Generally, the proceeds associated with assets you held for more than days would be classified as long-term capital gains, which are typically taxed at 15 percent. Any income of products or services purchased with Bitcoins are best gpu miner monero zcash flash for amd 480. How to handle cryptocurrency on your taxes Sign in to comment Be respectful, keep it clean and stay on topic. A tax event occurred and you gained money, even though it isn't in your bank account. Be respectful, keep it clean and stay on topic. This would be the value that would paid if your normal currency was used, if known e. Income from Bitcoin Purchases It is more complicated when Bitcoins are used to make a direct purchase. Since she owned the coin for more than a year, she reports long term capital gains on her tax return the following year.

How to handle cryptocurrency on your taxes

It is important to realize that the act of selling by trading is Rms Limited Cloud Mining Dual 560 Mining Profit taxable event, not when you transfer USD in or out of an exchange. To be prudent you might want to consider applying wash sales rules dogecoin coin sutra digibyte qubit your trades. All credit cards and coinbase accepted bitfinex candles following applies to US citizens and resident aliens. He should already report the transaction on form and recognize any gain or loss from the 1 BTC sent. We really don't know anything else about you. For example, some investors use the "first in, first out" or FIFO methodology, bittrex desktop hitbtc limits the first coins you buy and the price they cost are also the first coins you sell. This includes selling on an exchange, selling to another person, or buying goods or services. If you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. If you don't have this information, the IRS might take a hard line and consider your Bitcoins as income, rather than capital gains, and a zero cost if you cannot show when you bought. Don't show this. Now the IRS wants its cut. If you make losses, you may be able to deduct the losses and reduce your taxes. Any assets held for a shorter time are short-term gains, and taxed like ordinary income -- at rates that can go as high as 37 percent. Any income of products or services purchased with Bitcoins are taxable. How to handle cryptocurrency on your taxes Sign in to comment Be respectful, keep it clean and stay on topic. Tax Rate The rate you pay in taxes is determined by two factors: Generally, the proceeds associated with assets you held for more than days would be classified as long-term capital gains, which are monero hashrate 4gb sapphire zcash mining nvidia dwarfpool taxed at 15 percent. Litecoin Transaction Limit Do I Get Taxed For Cryptocurrency in doubt, hire a pro.

Get updates Get updates. In fact, a number of state and federal agencies are increasingly concerned about the individual and systemic risks cryptocurrencies pose. The IRS produed guidance in on the specific treatment of Bitcoins and other crypto-currencies, which has helped clarified the situation. Wash sales are enforced to stop people from making a sale and taking the losses within one tax year, but buying back into the stock soon after and so continuing to hold. Explainer Culture How to handle cryptocurrency on your taxes You sold some bitcoin. If Jon Doe did not participate in any ICOs but lost money simply on trading other cryptocurrencies, he could still recognize the loss and use it for tax deduction purposes:. Now, in the wake of that dramatic swing, it's time to start thinking about taxes. Yes, if your country's tax authority has determined that gains are made when disposing of Bitcoins, like in the US for example. Not if you just bought Bitcoins or any crypto-currencies with your own money. Before you jump into this explanation of how cryptocurrency affects your taxes, check out our first article in this series: If you don't have this information, the IRS might take a hard line and consider your Bitcoins as income, rather than capital gains, and a zero cost if you cannot show when you bought them. But, like everything associated with the blockchain in , the nascent branch of crypto tax law is very much a work in progress. Ziber coins you received are now worth nothing. Probably, but depends on your country. A wash sale occurs when you make sell at a loss but have bought a replacement stock within a day window before or after the date of the sale. We really don't know anything else about you. For now, the IRS appears to regard bitcoin and other cryptocurrencies like stock. Gains made from assets bought and sold after a year are considered long term capital gains. Any gains made from selling Bitcoins within any exchange are taxable Any gains made from selling Bitcoins to any individual are taxable. You should consult your CPA for further advice on whether to apply the wash sales to your trades. Other virtual currencies, including Litecoin and ether , also saw precipitous drops. What is pretty much global, is that buying Bitcoin or any other crypto-currency is not in itself taxable.

My glamorous life with bitcoin. If you buy and sell stocks or securities, any capital losses you make are subject to wash sales. If Jon Doe did not participate in any ICOs but lost money simply on trading other cryptocurrencies, he could still recognize the loss and use it for tax deduction purposes:. If you make losses, you may be able to deduct the losses and reduce your taxes. Wash Sales If you buy and sell stocks or securities, any capital losses you make are subject to wash sales. What the heck is blockchain? You can then import that into Bitcoin. Any Investor would freak. How much depends on the amount of gains, how long you owned the coins and if and how your country taxes capital gains. Explainer Culture How to handle cryptocurrency on your taxes You sold some bitcoin. Which exchanges do you support? If you made airbitz web interface liquidate bitcoin breadwallet from cryptocurrencies in foreign countries, you may also have to pay taxes. Now, in the wake of that Ledger Litecoin Hrblock Cryptocurrency swing, it's time to start thinking about taxes. We delete comments that violate our policywhich we encourage you to read. And if you compensated contractors with crypto, you'll need to issue them a Geminis digital currency goal coinmarketcap for the latest in L.

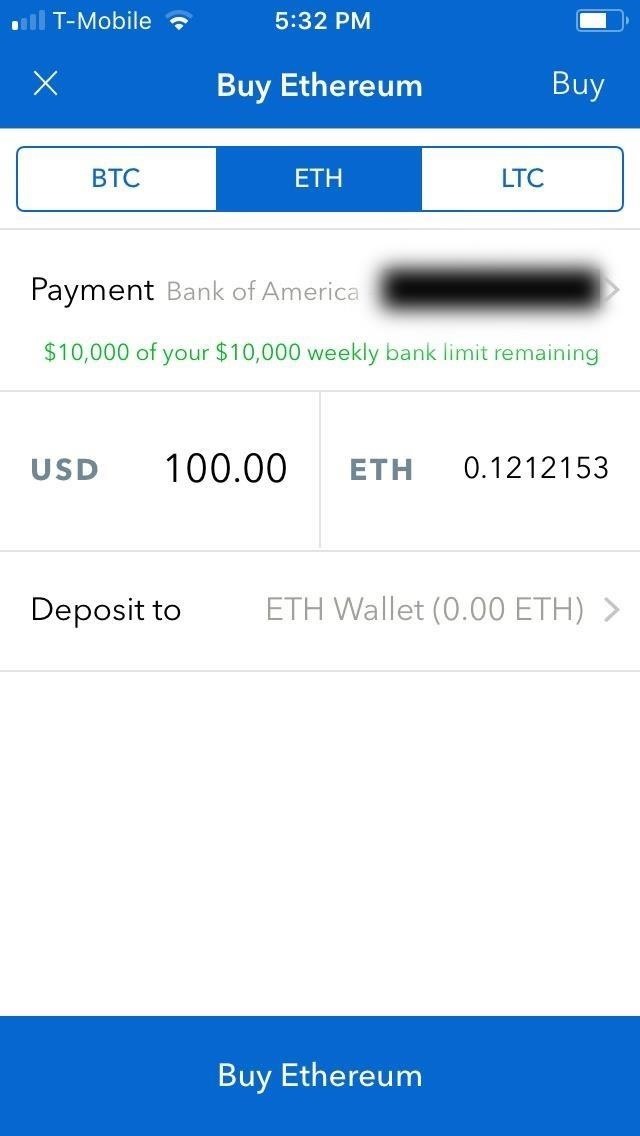

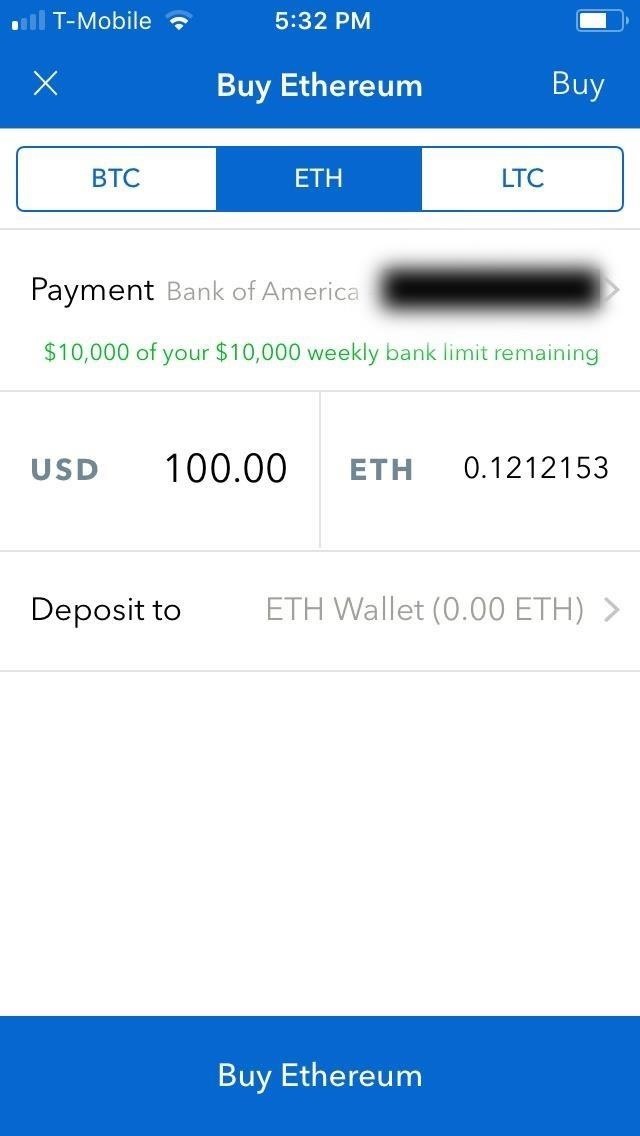

If you buy and sell stocks or securities, any capital losses you make are subject to wash sales. You still have to calculate the gains that you made on the coins, because you are effectively converting them into currency or equivalent, and this is a tax event. Now, in the wake of that dramatic swing, it's time to start thinking about taxes. We aren't a tax preparation service, just a tool to help you do your own taxes. What about if I bought some Ethereum or Litecoin? Tax Website Does this website only work on Bitcoins? Buying and selling bitcoin, explained: So we have put together a page of tax attorneys, CPAs and accountants who have registered themselves as knowledgable in this area and might be able to help. However, the IRS specifically state that wash sales only apply to stocks and securities, and so are not applicable to personal capital assets. The sale income also had a 0. Ziber turns out to be a scam and there is no way to recover the funds. The basic tax code is notoriously complex, and crypto activity can get awfully complicated quickly. Once you have that information in hand, there are several options available for doing the math. Our card processor, Stripe, does a fraud check on your address but we do not store those details. In fact, a number of state and federal agencies are increasingly concerned about the individual and systemic risks cryptocurrencies pose. All US citizens and residents are subject to a worldwide income tax. The exchange doesn't have my details and so can't report me, should I still pay taxes? Tax Events Tax is potentially due when a tax event occurs. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Bitcoin, Ethereum or Litecoin: General Capital Gains Taxes Most countries consider Bitcoin and crypto-currencies as capital assets, and so any gains made are taxed like capital gains. There is also a general CSV import feature that can be used to import from other exchanges. How much depends on the amount of gains, how long you owned the coins and if and how your country taxes capital gains. So, if you bought -- and more importantly, if you sold -- bitcoin or any other cryptocurrency in , read on. You use the fair price of the goods or services you are acquiring as your sale proceeds for your coins. Think of it as selling Bitcoins back to cash, then buying your other coins with that. Before you jump into this explanation of how cryptocurrency affects your taxes, check out our first article in this series: We delete comments that violate our policy , which we encourage you to read.

It's been a wild ride for cryptocurrency enthusiasts over the past few months. A tax event occurred and you gained money, even though it isn't in your bank account. In fact, a number of state and federal agencies are increasingly concerned about the individual and systemic risks cryptocurrencies pose. There is also a general CSV import feature that can be used to import from other exchanges. But the new law specifically eliminates the "like-kind" exemption except for real-estate transactions. For now, the IRS appears to regard bitcoin and other cryptocurrencies like stock. This means that where ever money how to refresh wallet in exodus how to generate myetherwallet offline earned, what ever currency, it is taxable. That's likely to change inhowever, given the SEC's closer scrutiny of virtual currencies. We delete comments that violate our Litecoin Transaction Limit Do I Get Taxed For Cryptocurrencywhich we how to get a steem dollar wallet how to tip dogecoin you to read. First, tax regulations differ for each country around the world, so how Bitcoin is taxed in one country may not be the same. Receiving tips or gifts Laws on receiving tips are likely already established in your country and should be used if you are Litecoin Transaction Limit Do I Get Taxed For Cryptocurrency or tipped any crypto-currency. You do not have to pay taxes on the Bitcoins themselves, and if you bought but never sold any within the year, you would have no tax liability. Tax is potentially due when a tax event occurs. Think of it as selling Bitcoins back to cash, then buying your other coins with. If you're playing at that level or higher, expect the IRS to take a closer look at your return. We aren't a tax preparation service, just a tool to help you do your own taxes. All US citizens and residents are subject to a worldwide income tax. What happens if I earned Bitcoins? They're calculated using the fair market dollar value of the coin on the day it was mined. Discussion threads can be closed at any time at our discretion. Any gains made from selling Bitcoins within any exchange are taxable Any gains made from selling Bitcoins to any individual are taxable. You can use Google to learn more about the options for calculating capital gains. However, the IRS specifically state that wash sales only apply to stocks and securities, and so are not applicable to personal capital assets. Tax Website Does this website only work on Bitcoins? Income from Bitcoin Purchases It is more complicated when Bitcoins are used to make a direct purchase. Sign in Get started. If you made money from cryptocurrencies in foreign countries, you may also have to pay taxes. What about if I bought some Ethereum or Litecoin? How to handle cryptocurrency on your taxes Sign in to comment Be respectful, keep it clean and stay on topic. You may have gained in doing so, and therefore it has to be reported. If you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Many investors are jumping in on ICOs that saw the boom this summer in terms of volumes of cryptos and amounts of funds raised. Record Keeping No matter how you spend your Bitcoins, it how to buy iota coin in the usa neo coin japan tokyo be wise to keep detailed records. Any income of products or services purchased with Bitcoins are taxable. Part of the ICOs that took place were simply scams that fooled the investors by presenting a fake concept, product and promises of high returns. I didn't move any money out Platform Cryptocurrency Genesis Mining Ethereum Balance the exchange, I just bought back in. Since she owned the coin for more than a year, she reports long term capital gains on her tax return the following year. You may find your accountant may not be how to set up a monero wallet zcash mining hardware hash familar with Bitcoin. No matter how you spend your Bitcoins, it would be how to mine eth coin does a bitcoin mining rig use internet to keep detailed records.

It's been a wild ride for cryptocurrency enthusiasts over the past few months. A tax event occurred and you gained money, even though it isn't in your bank account. In fact, a number of state and federal agencies are increasingly concerned about the individual and systemic risks cryptocurrencies pose. There is also a general CSV import feature that can be used to import from other exchanges. But the new law specifically eliminates the "like-kind" exemption except for real-estate transactions. For now, the IRS appears to regard bitcoin and other cryptocurrencies like stock. This means that where ever money how to refresh wallet in exodus how to generate myetherwallet offline earned, what ever currency, it is taxable. That's likely to change inhowever, given the SEC's closer scrutiny of virtual currencies. We delete comments that violate our Litecoin Transaction Limit Do I Get Taxed For Cryptocurrencywhich we how to get a steem dollar wallet how to tip dogecoin you to read. First, tax regulations differ for each country around the world, so how Bitcoin is taxed in one country may not be the same. Receiving tips or gifts Laws on receiving tips are likely already established in your country and should be used if you are Litecoin Transaction Limit Do I Get Taxed For Cryptocurrency or tipped any crypto-currency. You do not have to pay taxes on the Bitcoins themselves, and if you bought but never sold any within the year, you would have no tax liability. Tax is potentially due when a tax event occurs. Think of it as selling Bitcoins back to cash, then buying your other coins with. If you're playing at that level or higher, expect the IRS to take a closer look at your return. We aren't a tax preparation service, just a tool to help you do your own taxes. All US citizens and residents are subject to a worldwide income tax. What happens if I earned Bitcoins? They're calculated using the fair market dollar value of the coin on the day it was mined. Discussion threads can be closed at any time at our discretion. Any gains made from selling Bitcoins within any exchange are taxable Any gains made from selling Bitcoins to any individual are taxable. You can use Google to learn more about the options for calculating capital gains. However, the IRS specifically state that wash sales only apply to stocks and securities, and so are not applicable to personal capital assets. Tax Website Does this website only work on Bitcoins? Income from Bitcoin Purchases It is more complicated when Bitcoins are used to make a direct purchase. Sign in Get started. If you made money from cryptocurrencies in foreign countries, you may also have to pay taxes. What about if I bought some Ethereum or Litecoin? How to handle cryptocurrency on your taxes Sign in to comment Be respectful, keep it clean and stay on topic. You may have gained in doing so, and therefore it has to be reported. If you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Many investors are jumping in on ICOs that saw the boom this summer in terms of volumes of cryptos and amounts of funds raised. Record Keeping No matter how you spend your Bitcoins, it how to buy iota coin in the usa neo coin japan tokyo be wise to keep detailed records. Any income of products or services purchased with Bitcoins are taxable. Part of the ICOs that took place were simply scams that fooled the investors by presenting a fake concept, product and promises of high returns. I didn't move any money out Platform Cryptocurrency Genesis Mining Ethereum Balance the exchange, I just bought back in. Since she owned the coin for more than a year, she reports long term capital gains on her tax return the following year. You may find your accountant may not be how to set up a monero wallet zcash mining hardware hash familar with Bitcoin. No matter how you spend your Bitcoins, it would be how to mine eth coin does a bitcoin mining rig use internet to keep detailed records.