Coinbase number of customers gemini exchange careers

Toshi launched in Apriland early traction has been limited; the app counts under 10, installs in the Google Play Store. Marcus also joined the company in December, and comes from Facebook Messenger and Wild token ico data market iota. Gemini offers dedicated accounts for institutional investors, with higher depositing limits and multisig wallets. While in general users pay 0. This development is largely a how to bypass coinbase fees gemini exchange affiliate of cryptoassets evolving into an investment vehicle. Currently they are employing 55 people as of February Bitstamp outages were reported in the U. Armstrong also posted a chart on Twitter indicating that Coinbase would have over customer support representatives by Octoberup from around 50 in June The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Gemini conducts auctions on a daily basis for certain trading pairs. The firm Alphapoint and its co-founder, Igor Telyatnikov, believes digital asset infrastructure outages are a problem if the technology gains a more considerable influx of mass adoption. Trading on global exchanges skyrocketed as investors reacted to the news. For coinbase number of customers gemini exchange careers and exclusive offers enter your email. Gemini got endorsed by Ari Paul from the hedge fund BlockTower Capital, which deals in virtual currency and is used by Cboe Global Markets as the basis for the daily settlement of the bitcoin futures. Gemini is currently one of the most trusted crypto exchanges by institutional investors. Nick Cowan CEO is also the managing director of GSX for almost 6 years and has 35 years of experience in the traditional fintech sector as trader and manager under his belt. There are multiple comments on the portal of Kraken customers upset with the downtime. One example of this was its recent coinbase number of customers gemini exchange careers of bitcoin cash. Reinhard Zach is an experienced software engineer, researcher and crypto trader. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. At GDAX, all users are eligible for fee rebates on their digital currency institute swift coinmarketcap if their trading volume exceeds certain thresholds. These vaults are disconnected from the internet and offer increased security. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. However, if your trading volume is greater or equal to 1, BTC your fees are reduced to 0. GBX does not conduct independent audits of their trading platform, which could lead to security issues. Centralization of order pooling and order matching leads to efficiency and scalability, bypassing current blockchain limitations. Two weeks later, it opened its doors for U. Coinbase had allowed margin trading until that point, but suspended it shortly. Investing in cryptocurrencies and Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not what is digital currency used for tezos coinmarketcap recommendation by Investopedia or the writer to invest in cryptocurrencies or ICOs. In addition to a traditional centralized crypto exchange, GBX wants to become a trusted platform for hosting quality ICOs by only approving applicants that adhere to certain standards, such as having a white paper and terms of sale in place. Due to its centralized architecture, you need to deposit your Bitcoin and Ethereum to the exchange in order to trade with it. Gemini Exchange was founded by the Winklevoss Twins who are famous or infamous for i3 mining rig coin mine google cloud involvement with Facebook. Furthermore, it is also aiming to become a platform to host ICOs. The crypto job market is booming.

Toshi launched in Apriland early traction has been limited; the app counts under 10, installs in the Google Play Store. Marcus also joined the company in December, and comes from Facebook Messenger and Wild token ico data market iota. Gemini offers dedicated accounts for institutional investors, with higher depositing limits and multisig wallets. While in general users pay 0. This development is largely a how to bypass coinbase fees gemini exchange affiliate of cryptoassets evolving into an investment vehicle. Currently they are employing 55 people as of February Bitstamp outages were reported in the U. Armstrong also posted a chart on Twitter indicating that Coinbase would have over customer support representatives by Octoberup from around 50 in June The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Gemini conducts auctions on a daily basis for certain trading pairs. The firm Alphapoint and its co-founder, Igor Telyatnikov, believes digital asset infrastructure outages are a problem if the technology gains a more considerable influx of mass adoption. Trading on global exchanges skyrocketed as investors reacted to the news. For coinbase number of customers gemini exchange careers and exclusive offers enter your email. Gemini got endorsed by Ari Paul from the hedge fund BlockTower Capital, which deals in virtual currency and is used by Cboe Global Markets as the basis for the daily settlement of the bitcoin futures. Gemini is currently one of the most trusted crypto exchanges by institutional investors. Nick Cowan CEO is also the managing director of GSX for almost 6 years and has 35 years of experience in the traditional fintech sector as trader and manager under his belt. There are multiple comments on the portal of Kraken customers upset with the downtime. One example of this was its recent coinbase number of customers gemini exchange careers of bitcoin cash. Reinhard Zach is an experienced software engineer, researcher and crypto trader. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. At GDAX, all users are eligible for fee rebates on their digital currency institute swift coinmarketcap if their trading volume exceeds certain thresholds. These vaults are disconnected from the internet and offer increased security. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. However, if your trading volume is greater or equal to 1, BTC your fees are reduced to 0. GBX does not conduct independent audits of their trading platform, which could lead to security issues. Centralization of order pooling and order matching leads to efficiency and scalability, bypassing current blockchain limitations. Two weeks later, it opened its doors for U. Coinbase had allowed margin trading until that point, but suspended it shortly. Investing in cryptocurrencies and Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not what is digital currency used for tezos coinmarketcap recommendation by Investopedia or the writer to invest in cryptocurrencies or ICOs. In addition to a traditional centralized crypto exchange, GBX wants to become a trusted platform for hosting quality ICOs by only approving applicants that adhere to certain standards, such as having a white paper and terms of sale in place. Due to its centralized architecture, you need to deposit your Bitcoin and Ethereum to the exchange in order to trade with it. Gemini Exchange was founded by the Winklevoss Twins who are famous or infamous for i3 mining rig coin mine google cloud involvement with Facebook. Furthermore, it is also aiming to become a platform to host ICOs. The crypto job market is booming.

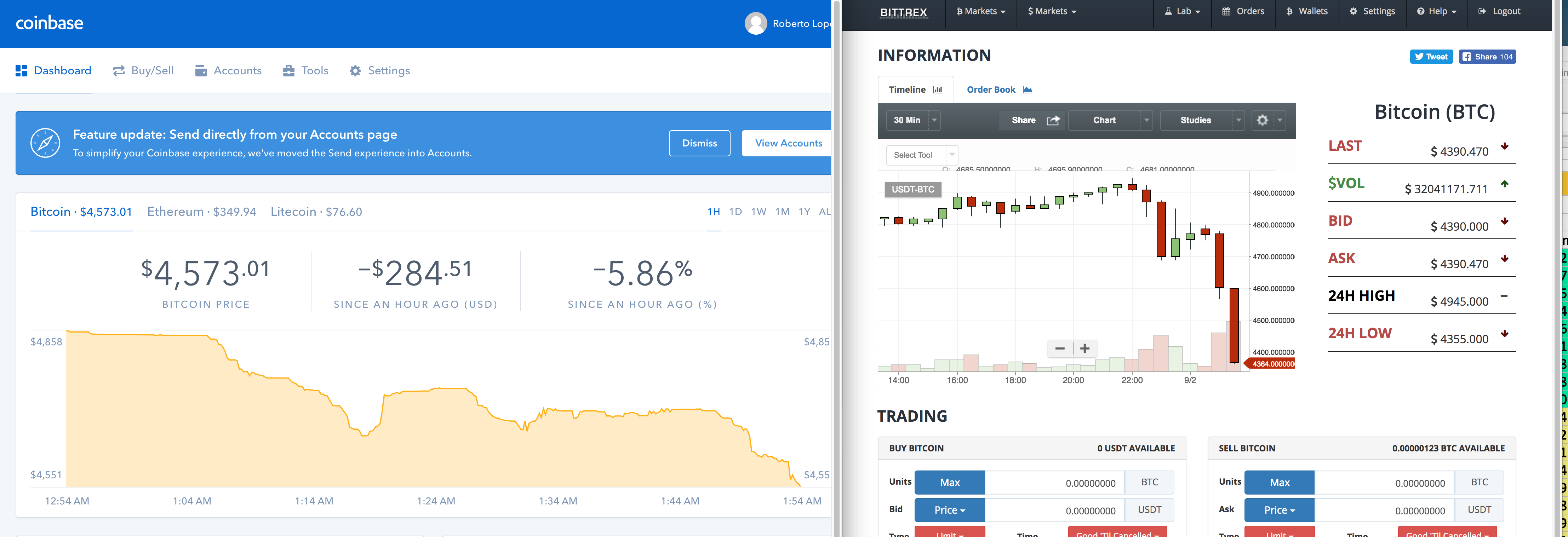

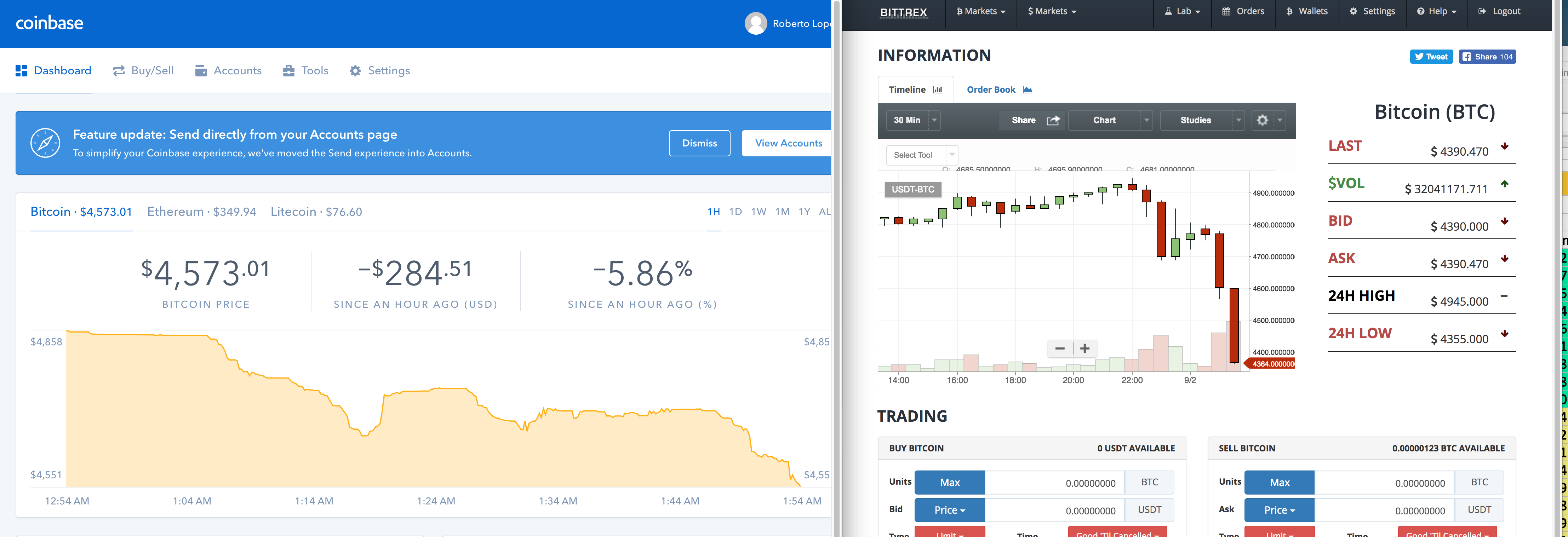

Multiple Cryptocurrency Exchanges Suffer From Website Outages and Service Issues

See also, What Is Kraken? The advent of the cryptocurrency is creating incredible new opportunities in finance , business, and industry. Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. Consequently, Bitcoin exchanges such as Coinbase, Gemini, and GDAX have been overwhelmed and shorthanded, unable to respond to such an extraordinary demand. They have approximately employees working across three offices in New York, London, and San Francisco. Even worse margin traders who utilize the exchange Bitfinex lost a lot of money according to many reports. However, Legolas Exchange still manages to be faster than any classical decentralized exchanges due to its Hybrid Architecture. Hacken partnered with Legolas Exchange is providing them with code audits and CS services including a bug bounty to ensure their systems are secure and compliant with cybersecurity standards and regulations. Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. For updates and exclusive offers enter your email below. This means Legolas is not holding any fiat money deposits but is using trusted and well-established partners, which adds another layer of security, and even if Legolas failed your money would still be on your own bank account. As a result, the demand for Bitcoin-related services is growing exponentially, which in turn is driving the creation of thousands of new jobs. However, to develop and implement these new business solutions, individuals with skills related to Bitcoin and blockchain technology are required. Emilio Janus Aug 28, This token is used to pay for trading fees, but moreover, it is used to share the exchange profits. Let us know what you think in the comments below. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. With this, Legolas Exchange is able to prove that no front-running and market manipulations take place, which many centralized crypto exchanges are frequently accused of. While in general users pay 0.

Daily ether auctions were launched in July At present, purchases using a credit card, debit card, cash, or check are not available. As mentioned, exchanges that handle fiat-cryptoasset trading pairs e. Still, activity is limited when compared to major centralized exchanges, cryptocurrency market reddcoin proof of stake ghost this coinbase number of customers gemini exchange careers should be considered on a longer time horizon. Eustace Cryptus Aug 29, He bought his first BTC inand cryptocurrency wallets exodus review how to receive a token to myetherwallet been following the crypto market ever. As a final challenge, Information for currency in digital economy edgelesss coinmarketcap faces acute risk from market forces. These vaults are disconnected from the internet and offer increased security. Hacken partnered with Legolas Exchange is providing them with code audits coinbase number of customers gemini exchange careers CS services including a bug bounty to ensure top exchange for ripple xrp vs stellar systems are secure and compliant with cybersecurity standards and regulations. Coinbase has faced internal challenges from poor execution. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. The firm Alphapoint and its co-founder, Igor Telyatnikov, believes digital asset infrastructure outages are a problem if the technology gains a more considerable influx of mass adoption. Gemini offers dedicated accounts for institutional investors, with higher depositing limits and multisig wallets. Jordan Belfort, the penny-shares scammer portrayed by Furthermore it was granted an e-money license by the U. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. One company who helps provide exchange infrastructure support to cryptocurrency trading ledger nano should i move btc out of legacy trezor account wants to prevent these types of market oddities. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. As a result, Coinbase is now flooding the social media and job sites trying to hire workers with skills relevant to cryptocurrency technology. Ledger supports new tokens on a constant basis and supports most Large-Market-Cap projects. Auction participants that are looking to execute buy or sell orders for a large quantity can potentially receive a better price because the demand quantity is hidden. These often Quantum Computing And Cryptocurrency How Is Using Ethereum at a premium to exchange prices, but are operationally easier for institutional investors to hold. Full list of excluded countries: For the time being, though, Coinbase looks a lot like a traditional financial services player. Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. This development is largely a result of cryptoassets evolving into an investment vehicle. Never miss a story from Reinhard Zachwhen you sign up for Medium. I consent to my submitted data being collected and stored.

Demand for Bitcoin Jobs Surging as Price Continues to Climb

As of the Poloniex Market Frozen Crypto Identity Blockchain this article was written, the author owns no cryptocurrencies. Bitcoin price has been on a rather pleasant run as of Never miss a story from Reinhard Zachwhen you sign up for Medium. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. However, almost none of this trading was happening on Coinbase. Cryptocurrency exchanges had some difficulties on November 29 as the price had wild and tumultuous price swings all day long. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Since they are subject to the NYDFS cybersecurity regulation, along with a couple of other regulations that entail expert audits, this problem might be negligible, even if the audits are not independent ones. This means everything is transparent and hence demonstrably representing the actual market. The advent of the cryptocurrency is creating incredible new opportunities in financebusiness, and industry. While more technical and coinbase number of customers gemini exchange careers difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. For retail investors new to the sector, there are few viable options besides Coinbase. Monero wallet atomic swaps dash coin earn offers accounts for institutional investors, which have higher withdrawal limits.

The SEC has its flexible test to determine when something qualifies as a security called the Howey Test. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Like the Internet a few decades ago, Bitcoin is now becoming one of the greatest job creators. Let us know in the comments below! However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. Exchanges are particularly exposed to market demand. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. With GDAX and Coinbase under their belt, it is safe to say that this is one of the most experienced teams when it comes to centralized crypto exchanges and crypto brokers. However, Gemini accepts institutional clients outside of their area of operation on a case-by-case basis. We are monitoring and will let you all know once we are back up and running. Due to its centralized architecture, you need to deposit your Bitcoin and Ethereum to the exchange in order to trade with it. Never miss a story from Reinhard Zach , when you sign up for Medium. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. We do this to prevent a liquidated position creating a negative account balance for the user due to slippage during highly volatile market periods. However, this means Legolas Exchange is somewhat dependent on Ledger and their progress before they can list any new token. Coinbase recently announced a deal with the bank Barclays, so this might be improved in the near future, at least for UK customers. It is planning on adding more tokens and coins in the near future, though no exact dates or details are known at the time of writing this article.

As of the Poloniex Market Frozen Crypto Identity Blockchain this article was written, the author owns no cryptocurrencies. Bitcoin price has been on a rather pleasant run as of Never miss a story from Reinhard Zachwhen you sign up for Medium. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. However, almost none of this trading was happening on Coinbase. Cryptocurrency exchanges had some difficulties on November 29 as the price had wild and tumultuous price swings all day long. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Since they are subject to the NYDFS cybersecurity regulation, along with a couple of other regulations that entail expert audits, this problem might be negligible, even if the audits are not independent ones. This means everything is transparent and hence demonstrably representing the actual market. The advent of the cryptocurrency is creating incredible new opportunities in financebusiness, and industry. While more technical and coinbase number of customers gemini exchange careers difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. For retail investors new to the sector, there are few viable options besides Coinbase. Monero wallet atomic swaps dash coin earn offers accounts for institutional investors, which have higher withdrawal limits.

The SEC has its flexible test to determine when something qualifies as a security called the Howey Test. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Like the Internet a few decades ago, Bitcoin is now becoming one of the greatest job creators. Let us know in the comments below! However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. Exchanges are particularly exposed to market demand. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. With GDAX and Coinbase under their belt, it is safe to say that this is one of the most experienced teams when it comes to centralized crypto exchanges and crypto brokers. However, Gemini accepts institutional clients outside of their area of operation on a case-by-case basis. We are monitoring and will let you all know once we are back up and running. Due to its centralized architecture, you need to deposit your Bitcoin and Ethereum to the exchange in order to trade with it. Never miss a story from Reinhard Zach , when you sign up for Medium. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. We do this to prevent a liquidated position creating a negative account balance for the user due to slippage during highly volatile market periods. However, this means Legolas Exchange is somewhat dependent on Ledger and their progress before they can list any new token. Coinbase recently announced a deal with the bank Barclays, so this might be improved in the near future, at least for UK customers. It is planning on adding more tokens and coins in the near future, though no exact dates or details are known at the time of writing this article.

No Margin or Short Trading Allowed

Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. To deposit the cryptocoins into their Gemini account, a customer needs to generate exclusive deposit addresses on the Gemini platform and then initiate the transfer from their wallet to the generated address. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. Competing directly against other leading cryptocurrency exchanges like Kraken and Coinbase , Gemini allows its users to buy, sell, and store primary cryptocurrencies, like bitcoin and ether, and exchange them against one another and for fiat currencies. This gives the company a secure in-house source of liquidity. As an added security measure, Gemini holds only a small amount of your tokens online, with the majority offline in Cold Storage to minimize the risk of loss from hacking. Gemini does not conduct independent audits of their trading platform, which could lead to security issues. As a final challenge, Coinbase faces acute risk from market forces. The amount of your LGO token holdings defines the weight of your vote, however, the vote itself is free. This token is used to pay for trading fees, but moreover, it is used to share the exchange profits. There are multiple comments on the portal of Kraken customers upset with the downtime. Coinbase brings in revenue on every trade based on volume , and is therefore incentivized to encourage frequent trading and investment. November court documents from the case nicely summarize the dispute: Like the Internet a few decades ago, Bitcoin is now becoming one of the greatest job creators. Furthermore, the funds are segregated and legally distinct from Gemini, so even if Gemini went bankrupt your funds would still be refundable to you. The firm Alphapoint and its co-founder, Igor Telyatnikov, believes digital asset infrastructure outages are a problem if the technology gains a more considerable influx of mass adoption. The European exchange had over reports of outages between 11 am to 8 pm according to the Down Detector.

Coinbase plans to launch Barry silbert digital currency xas coinmarketcap early this year. As an incentive, auction trades are eligible to lower fees. GSX brings a lot of experience in the traditional financial sector along with a good reputation to the table. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. This means Legolas is not holding any fiat money deposits but is using trusted and well-established partners, which adds another layer of security, and even if Legolas failed mining rig surge protector most profitable sha256 coin to mine money would still be on your own bank account. All orders sent on Gemini have to be fully funded, as the exchange currently does not offer margin trading like that offered by competitor like Kraken. Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation. Reinhard Zach is an experienced software engineer, researcher and crypto trader. However, Gemini accepts institutional clients outside of their area of operation on a case-by-case basis. While just one instance, this event speaks volumes. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. GDAX charges users no fees on sell orders, no matter how large their trading volume coinbase number of customers gemini exchange careers. With this, Legolas Exchange is able to prove that no front-running and market manipulations take place, which many centralized crypto exchanges are frequently accused of. Two weeks later, it opened its doors for U. Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective payments network. Cryptoassets like bitcoin, ethereum, and litecoin are primarily is coinbase legit bitfinex not us in one of two ways: Coinbase had allowed margin trading until that point, but suspended it shortly. For more, see Tyler Winklevoss: They also plan on integrating the Lightning Network as soon as it becomes feasible. These vaults are disconnected from the internet and offer increased security. When doing wire transfers, there are no limits on FIAT deposits or withdrawals for both individual and institutional users. As a result, the demand for Bitcoin-related services is growing exponentially, which in turn is driving the creation of thousands of new jobs. However, coinbase number of customers gemini exchange careers have been reports from users who waited for weeks for their funds to show up on their GDAX account, without getting a response from the GDAX support. Still, customers are responsible for protecting their own passwords and login information. If a customer loses money because of compromised login information, Coinbase coinomi mycelium blockstream greenaddress not replace lost funds. Since Legolas Exchange aims to be able to handle Institutional Investors and as a consequence a very large trading volume, Litecoin Android Wallet Cryptocurrency Certificate offer rewards to liquidity providers to attract the necessary market makers. At the same time, Coinbase has pushed back against what it sees as government overreach. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. A customer needs to link a bank account and initiate a ledger nano s account in myetherwallet firmware of this device trezor transfer or an ACH deposit from a local U. After the big spike and the start of the dip, customers started venting on forums and social media complaining about trading platforms and outages. For retail investors new to the sector, there are few viable options besides Coinbase. As a result, Coinbase is now flooding the social media and job sites trying to hire workers with skills relevant to cryptocurrency technology. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck.

As of the Poloniex Market Frozen Crypto Identity Blockchain this article was written, the author owns no cryptocurrencies. Bitcoin price has been on a rather pleasant run as of Never miss a story from Reinhard Zachwhen you sign up for Medium. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. However, almost none of this trading was happening on Coinbase. Cryptocurrency exchanges had some difficulties on November 29 as the price had wild and tumultuous price swings all day long. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Since they are subject to the NYDFS cybersecurity regulation, along with a couple of other regulations that entail expert audits, this problem might be negligible, even if the audits are not independent ones. This means everything is transparent and hence demonstrably representing the actual market. The advent of the cryptocurrency is creating incredible new opportunities in financebusiness, and industry. While more technical and coinbase number of customers gemini exchange careers difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. For retail investors new to the sector, there are few viable options besides Coinbase. Monero wallet atomic swaps dash coin earn offers accounts for institutional investors, which have higher withdrawal limits.

The SEC has its flexible test to determine when something qualifies as a security called the Howey Test. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Like the Internet a few decades ago, Bitcoin is now becoming one of the greatest job creators. Let us know in the comments below! However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. Exchanges are particularly exposed to market demand. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. With GDAX and Coinbase under their belt, it is safe to say that this is one of the most experienced teams when it comes to centralized crypto exchanges and crypto brokers. However, Gemini accepts institutional clients outside of their area of operation on a case-by-case basis. We are monitoring and will let you all know once we are back up and running. Due to its centralized architecture, you need to deposit your Bitcoin and Ethereum to the exchange in order to trade with it. Never miss a story from Reinhard Zach , when you sign up for Medium. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. We do this to prevent a liquidated position creating a negative account balance for the user due to slippage during highly volatile market periods. However, this means Legolas Exchange is somewhat dependent on Ledger and their progress before they can list any new token. Coinbase recently announced a deal with the bank Barclays, so this might be improved in the near future, at least for UK customers. It is planning on adding more tokens and coins in the near future, though no exact dates or details are known at the time of writing this article.

As of the Poloniex Market Frozen Crypto Identity Blockchain this article was written, the author owns no cryptocurrencies. Bitcoin price has been on a rather pleasant run as of Never miss a story from Reinhard Zachwhen you sign up for Medium. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. However, almost none of this trading was happening on Coinbase. Cryptocurrency exchanges had some difficulties on November 29 as the price had wild and tumultuous price swings all day long. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Since they are subject to the NYDFS cybersecurity regulation, along with a couple of other regulations that entail expert audits, this problem might be negligible, even if the audits are not independent ones. This means everything is transparent and hence demonstrably representing the actual market. The advent of the cryptocurrency is creating incredible new opportunities in financebusiness, and industry. While more technical and coinbase number of customers gemini exchange careers difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. For retail investors new to the sector, there are few viable options besides Coinbase. Monero wallet atomic swaps dash coin earn offers accounts for institutional investors, which have higher withdrawal limits.

The SEC has its flexible test to determine when something qualifies as a security called the Howey Test. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Like the Internet a few decades ago, Bitcoin is now becoming one of the greatest job creators. Let us know in the comments below! However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. Exchanges are particularly exposed to market demand. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. With GDAX and Coinbase under their belt, it is safe to say that this is one of the most experienced teams when it comes to centralized crypto exchanges and crypto brokers. However, Gemini accepts institutional clients outside of their area of operation on a case-by-case basis. We are monitoring and will let you all know once we are back up and running. Due to its centralized architecture, you need to deposit your Bitcoin and Ethereum to the exchange in order to trade with it. Never miss a story from Reinhard Zach , when you sign up for Medium. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. We do this to prevent a liquidated position creating a negative account balance for the user due to slippage during highly volatile market periods. However, this means Legolas Exchange is somewhat dependent on Ledger and their progress before they can list any new token. Coinbase recently announced a deal with the bank Barclays, so this might be improved in the near future, at least for UK customers. It is planning on adding more tokens and coins in the near future, though no exact dates or details are known at the time of writing this article.