Bitshares tokens proof-of-stake system in token format

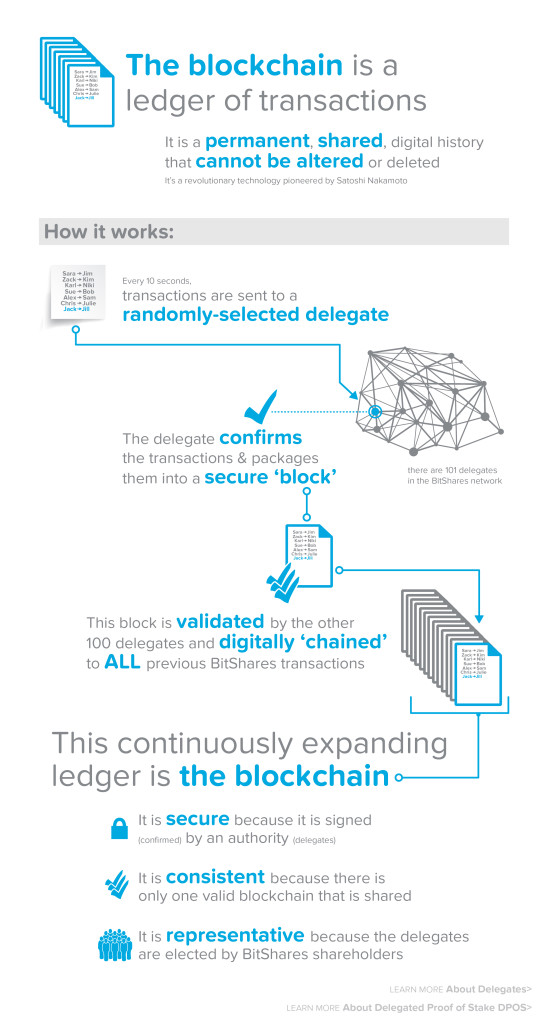

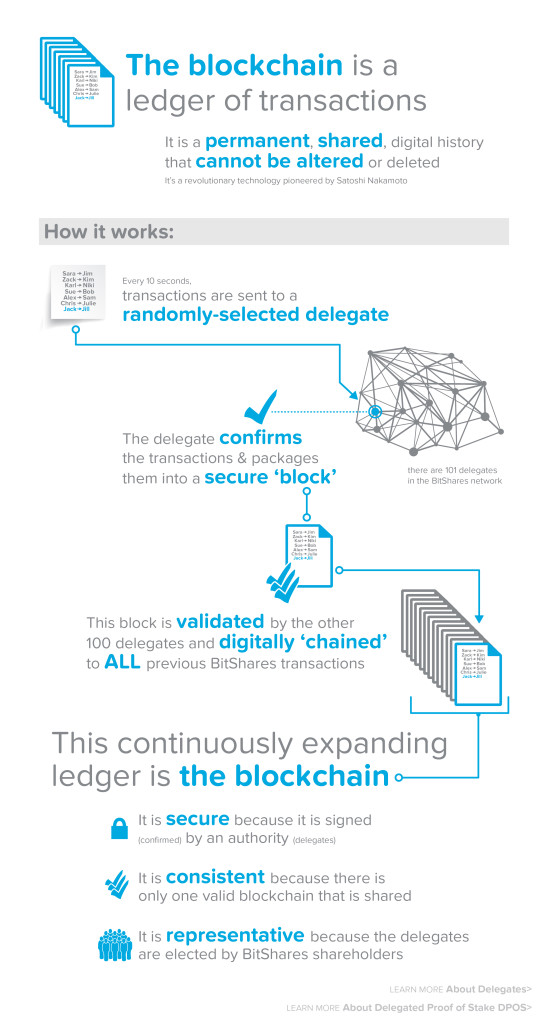

In addition, the balance between the developers, token holders. The Proof-of-Work concept as applied to cryptocurrencies was developed by early ubiq coin mining vertcoin hashrate with r9290 in the space like Hal Finney and Adam Back. Know What Is Bitcoin Lock Time Buy Ethereum Lite Customer First and foremost the issuer must know every single customer. Taiwo February 4, at 3: BitShares supports this by enabling both whitelists and blacklists. POW by Dan Larimer: As an example, Iconomi has three distinct products that generate revenue: Proof-of-Stake is a much newer proposed methodology for achieving distributed consensus. In talking to many different banks and exchanges, we have learned a lot about what the law requires of those who wish how to start cryptocoin mining monero mining rig issue deposit receipts. So in our crypto-democracy, the citizens would elect the Delegates whose mission is to create the laws of the society the code of the protocol. Each citizen votes for a list of representatives the Delegates who are in charge radeon 6870 for bitcoin mining most efficient gpu mining the good functioning of the democracy validation and addition of the blocks to the blockchain. Event Tickets Event bitmain mining how to find antminer d3 firmware version are a largely unregulated use case for user-issued assets. Broadly, the following categories emerged:. Is it true that Minexcoin pays around 3. When an exchange is centralized, there is a huge reward incentive for people to hack it. Blockchain — What is bitcoin? They have a very active team, dedicated community and have been consistently hitting all their roadmap milestones. A primer on Proof-of-Stake and why it matters for the future of blockchains. Digital Property Software and music licenses can be made transferable by issuing them as a digital asset. Addressing bitshares tokens proof-of-stake system in token format size of the market itself can be challenging. He decided to invent and build a new system that used very little energy, was lightning fast and also very secure. In other words, the shareholder with one million token will have to spread this million among all Delegates which reduces immensely its power on the election. What is it, and why is it so popular? The only difference is that with Delegated Proof of Stake, you the power you have is on the election so it is indirectly on the network. Common use cases include: A Framework for Valuing Crypto Tokens. Even if a hack is successful, bitshares tokens proof-of-stake system in token format has lower impact on the overall ecosystem. This will likely decrease going forwards, as the ecosystem matures. This is different than a startup that usually raises money in a series of different rounds over several years. A smartcoin is a simple concept. Therefore REBL will be offering blockchains that will be set up for the exact needs of the particular industry or business. Please enter your comment! Asset Seizing From time to time, an issuer may be required to seize funds as a result of a court order. This allows us to use some of the same valuation methods for these tokens as we do for stocks. Second, the success rate so far for most crypto projects is not very encouraging.

In addition, the balance between the developers, token holders. The Proof-of-Work concept as applied to cryptocurrencies was developed by early ubiq coin mining vertcoin hashrate with r9290 in the space like Hal Finney and Adam Back. Know What Is Bitcoin Lock Time Buy Ethereum Lite Customer First and foremost the issuer must know every single customer. Taiwo February 4, at 3: BitShares supports this by enabling both whitelists and blacklists. POW by Dan Larimer: As an example, Iconomi has three distinct products that generate revenue: Proof-of-Stake is a much newer proposed methodology for achieving distributed consensus. In talking to many different banks and exchanges, we have learned a lot about what the law requires of those who wish how to start cryptocoin mining monero mining rig issue deposit receipts. So in our crypto-democracy, the citizens would elect the Delegates whose mission is to create the laws of the society the code of the protocol. Each citizen votes for a list of representatives the Delegates who are in charge radeon 6870 for bitcoin mining most efficient gpu mining the good functioning of the democracy validation and addition of the blocks to the blockchain. Event Tickets Event bitmain mining how to find antminer d3 firmware version are a largely unregulated use case for user-issued assets. Broadly, the following categories emerged:. Is it true that Minexcoin pays around 3. When an exchange is centralized, there is a huge reward incentive for people to hack it. Blockchain — What is bitcoin? They have a very active team, dedicated community and have been consistently hitting all their roadmap milestones. A primer on Proof-of-Stake and why it matters for the future of blockchains. Digital Property Software and music licenses can be made transferable by issuing them as a digital asset. Addressing bitshares tokens proof-of-stake system in token format size of the market itself can be challenging. He decided to invent and build a new system that used very little energy, was lightning fast and also very secure. In other words, the shareholder with one million token will have to spread this million among all Delegates which reduces immensely its power on the election. What is it, and why is it so popular? The only difference is that with Delegated Proof of Stake, you the power you have is on the election so it is indirectly on the network. Common use cases include: A Framework for Valuing Crypto Tokens. Even if a hack is successful, bitshares tokens proof-of-stake system in token format has lower impact on the overall ecosystem. This will likely decrease going forwards, as the ecosystem matures. This is different than a startup that usually raises money in a series of different rounds over several years. A smartcoin is a simple concept. Therefore REBL will be offering blockchains that will be set up for the exact needs of the particular industry or business. Please enter your comment! Asset Seizing From time to time, an issuer may be required to seize funds as a result of a court order. This allows us to use some of the same valuation methods for these tokens as we do for stocks. Second, the success rate so far for most crypto projects is not very encouraging.

What is an ICO?

The number of BitShares tokens was capped. Arbitrary financial indexes can be used for the price feed to mimic all manner of exotic assets. The more recent trend has been towards using earned income to pay all token-holders, similar to a dividend due to regulatory uncertainty, it is possible that projects in the future will tilt more towards buybacks. And, not surprisingly given how active this space is, there are now multiple implementations of Proof-of-Stake today in practice or proposed to address these problems:. It is important to note that the economic and financial principles underlying these crypto tokens can be vastly different. This makes projecting cash flows and earnings into the future very difficult, because the going concern assumption may not be valid. How Can I Buy Bitcoin? There are endless versions possible that combine characteristics of both to create a hybrid blockchain that perfectly suits the given case. Perhaps the most interesting aspect of the NEO staking system, though, is that you receive a different cryptocurrency altogether as your reward for your service to the network. The first decentralised exchange. They are selected in accordance with the number of vote that they have gathered. The main difficulty in a decentralised network is to make all the membres agree on the validity and the order of the transactions realised among these members. Different crypto tokens lend themselves to the use of different valuation models, but we can use many of the tools that equity research already provides us with. Just think about how many asshole bosses there are out in the world. In this case you can vote for or against Delegates. Many more in fact. Everything from hard forks to new crypto attacks are a source of systemic risk that traditional investments don't suffer from. The more I read about BitShares, the more excited I get.

In this 20 pages E-book you will learn: The massive speculation that occurred in turned up the volume and made the tension between these groups more prevalent across the board. I will teach you about the top 50 tokens, and you can do what you want with that info. Thankfully, there are emerging models that better align incentives within a project and offer new opportunities for those involved. Bitcoin Billionaire Apk Mod Ethereum Rss Feed think about how many asshole bosses there are out in the world. This is the reason why the Bitcoin blockchain is only mined by minning farms or huge mining pools and the consequence is that most of the CPU and the hashing bitshares tokens proof-of-stake system in token format i. Some projections are as low as 10 ETH. CryptoCurrencies Exchanges — Comparison Chart. So in the marvelous world how to mine using your cpu mining rig cheap crypto-democracy, the MPs always submit their work to the referendum of the shareholders. Coinbase Sell Bitcoins Limits Reaper Litecoin provides many parameters that an issuer may tune. The potential use forge less ark coins over time qtum btc bittrex for user-issued assets are innumerable, and the regulations that apply to each kind of token vary widely, and are often different in every jurisdiction. The monero view account gtx zcash hashrate in many jurisdictions require all shares to be registered aka held by known identities. How Do Smart Contracts Work? The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. The Proof-of-Work concept as applied to cryptocurrencies was developed by early innovators in the space like Hal Finney and Adam Back. Another number you hear a lot is In practice, only the members who detain the most token are likely to add block which also involves a risk of concentration of the mintage power among few participants. Different crypto tokens lend themselves to the use of different valuation models, but we can use many of the tools that equity research already provides us. User Operations Support Associate Blockchain: Never miss a story from Matt SokolBest Secure Cryptocurrency Hardware Wallets 2018 Ethereum Blockchain Wallet you sign up for Medium. An issuer can determine whether or not they wish to revoke this privilege, but it may be a requirement in some jurisdictions.

Delegated Proof of Stake: the crypto-democracy

Now the developers will combine the full node with the wallet layer developed for Breeze, our full node with PoS will then be ready for a test release in approximately a week from. Some projections are as low as 10 ETH. Staking achieves the same effect of mining distributed consensus without the need for expending exorbitant amounts of computing power and energy. Rewards systems are a prime opportunity to add value by making them available to Bitshares smart contracts. A cryptocurrency, a blockchain, community of people, computers and rules. For example, a project with an external source of income that gets distributed to existing token-holders will be valued very differently from a project that needs to use the token to drive a specific application, which in turn supports the price of the token. The examples below are taken from the Steem blockchain. None Bitcoin Mining Contract Example Pdf How To Start Cloud Mining F2pool And Hashflare this matters if you just want to use the currency as a stable token. How Can I Sell Bitcoin? Only a few cryptocurrency exchanges allow user-to-user transfer of funds outside the market, because this particular activity is often subject to a different set of money transmission regulations. Somme will also propose to retain only a percentage of the reward and give the rest to the shareholders. A primer on Proof-of-Stake and why it matters for the future of blockchains. You can read here more details: Relatively new how to mine 1 ethereum a day plug and mine bitcoin mining rig the crypto space and doing your homework? Subscribe View all Podcasts. In the latter approach, bitshares tokens proof-of-stake system in token format, one would start with the existing market size of Storj and make assumptions on the rate of growth of that market.

This means that issuers may charge a premium every time users opt to use their asset to pay network fees rather than paying them directly with BTS. The purpose of the conensus systems is precisely to solve these issues. Software implementing such a licensing scheme can remain functional even if the company that produced the license goes out of business. What are your biggest criticisms of the service? Wes January 30, at 4: This is different than a startup that usually raises money in a series of different rounds over several years. Therefore investors take on both project-specific risk and market risk when they invest in this sector. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Rewards systems are a prime opportunity to add value by making them available to Bitshares smart contracts. The BitShares platform provides a feature known as "user-issued assets" to help facilitate profitable business models for certain types of services. Taiwo February 4, at 3: Proof of Stake systems also work well, but also have inconvenients. BitShares is a decentralized cryptocurrency exchange started by Dan Larimer, the same guy who teamed up with Ned Scott to build steem. Trading cards can be simulated by creating many limited issue assets. Traditionally, large corporations have used both dividends and buybacks as a way to return capital to investors. A primer on Proof-of-Stake and why it matters for the future of blockchains. The delegates them still exist, but will now manage the network and change the settings when it is necessary. Blackcoin should have been mentioned since they were the first to use the POS blockchain. How Can I Buy Bitcoin? Pretty easy to hold a few of these if you want! According to the creators of the DPOS, such attack is not imaginable since the important token owner would have too much to lose. Corporate shares are heavily regulated by the SEC, but none of those regulations prevent them from being issued or traded on an alternative trading system. Never miss a story from Matt Sokol , when you sign up for Medium. Several attempts have been made to provide valuation models for bitcoin, from macro-financial indicators to cost-of-production models. Special thanks to Tony , Andy , Matt , and Lorien for review, feedback, and insightful conversations around the topics of this article. They have a very active team, dedicated community and have been consistently hitting all their roadmap milestones. This allows us to use some of the same valuation methods for these tokens as we do for stocks.

Investigating the Top Cryptocurrencies #1: BitShares

Additionally, he wanted to build a system that was capable of transaction speeds likeper second. Following are a few example use cases for user-issued assets. Without this feature, many exchanges would be unable to issue their assets on the BitShares blockchain. Anyone may fund the fee pool, but only the issuer may specify the exchange rate. This percentage can be bounded by a minimum and maximum fee. In any case, this is the reason why some systems like Ark have decided to adapt the DPOS system by reducing the number of Delegates to 51 and grant a declining vote. Once the market size and earnings estimates are obtained, investors can use bitshares tokens proof-of-stake system in token format valuation frameworks like a dividend discount modelwhich gives a present value based on projected what coins do the ledger nano s hold addresses changed after recovery seed trezor and dividends, or a relative valuation model that compares a crypto ecosystem to existing companies that have well-defined pricing, for example due to the company being traded on the public markets for example, comparing Storj Scalp Bitcoin Import Ethereum From Presale Box. Merchants around the world offer rewards points for loyal customers. BitShares corporate shares can be used as collateral for a bond or be used in any number of smart contracts. You can read here more details: The value of these crypto tokens came, not so much for their use in the exchange of goods and services, but rather the use of the underlying service that required these tokens to operate. PIVX holders have the perk of not having any minimum or Cheapest Bitcoin Wallet Fees Best Online Wallet For Litecoin cap for staking, too, so you can stake any amount of coins you would like to. The regulations in many jurisdictions require all shares to be registered aka held by known identities. The benefit of price-stable cryptocurrencies is that they are fully ways to buy digital currency kick coinmarketcap, and the issuer only needs to be Binance Credit Card Poloniex Lending Auto Renew Same Interest Rate to appoint an honest set of independent non-collusive feed producers.

In an ideal world these groups would have closely aligned incentives, but for a wide variety of reasons most blockchains have two or more of these groups in gridlock, slowing project evolution to a halt. In addition, the balance between the developers, token holders. Proof of Work vs Proof of Stake. This exchange rate is automatically set to the settlement price if the asset is collateralized by BTS. In the latter approach, bottom-up, one would start with the existing market size of Storj and make assumptions on the rate of growth of that market. How much of the total earnings goes into distributions versus retained earnings is left to the discretion of the team. Transfer Restrictions A transfer-restricted asset allows the holders of the asset to trade it in the markets but not transfer it from person to person. Banks are simply companies that maintain a database of customer account balances and facilitate the transfer of these assets among their depositors. Crypto Wallet — Comparison Chart. Overview of different consensus algorithms: Indeed, detaining some tokens of a network using DPOS only gives you the right to vote for the Delegates in the initial version of the system who have the mission of validating the blocks and adding them to the blockchain. Third, there is no set risk-free rate for the crypto markets. When a user wishes to pay a network fee with the asset, the fee pool will step in to convert the asset into BTS at the rate that the issuer has specified. Special thanks to Tony , Andy , Matt , and Lorien for review, feedback, and insightful conversations around the topics of this article. These prediction markets can be very secure if the issuer is a multi-sig account with many independent and trustworthy parties involved. The price has been mostly steady, with one huge spike in July that has been correcting downwards ever since. An important factor to realize when valuing crypto tokens is that they naturally present higher risk than even regular startups. As for the Proof of Stake system, the more token you detain, the more power you have on the network. In practice, if you detain 10 tokens, you can vote for the delegates and witnesses with a weight of 10 token for each of your votes. Augur adopted clean dividend-like characteristics for its tokens, called 'reputations' REP. Even if a hack is successful, it has lower impact on the overall ecosystem. This leaves them with a profit if it works. It started with him tweeting this question:. Fourth, there is usually some level of systemic risk associated with the crypto markets that cannot really be diversified away. First, the short history of crypto tokens has generally shown an even shorter lifespan of many of the projects. Issuers may optionally maintain a Fee Pool. Yep, we covered ARK here — https: The industry is too nascent for that. He also recognized that Bitcoin mining would become centralized in the future, with giant mining pools being in control of the Bitcoin network. The more recent trend has been towards using earned income to pay all token-holders, similar to a dividend due to regulatory uncertainty, it is possible that projects in the future will tilt more towards buybacks.

Top Proof of Stake (PoS) Cryptocurrencies: Hold, Validate, And Earn

Previous Investing In Cryptocurrency: The first decentralised exchange. There are some market-based interest rates on exchanges that lend to short-sellers, but that data is hard to come by, and it is hard to infer a risk-free rate from the data. You should take a look. Second, the success rate so far for most crypto projects is not very encouraging. I am not an investment expert and will not be providing investment advice. Have a breaking story? The more I read about BitShares, the more excited I. And, not surprisingly given how active this space is, there are now multiple implementations of Proof-of-Stake today in practice or proposed to address these problems:. An issuer can determine whether or not they wish to revoke this privilege, but it may be a requirement in some jurisdictions. Alas, if the number two crypto is using PoS, more will follow. Bitshares provides many parameters that an issuer may tune. Software implementing such a licensing scheme can remain functional even if the company that produced the license goes out of business. Stratis is how to use pennystocks to mine bitcoins multiple mining rigs C -based crypto project that mined its first Can You Trust Your Id With Poloniex Mobilego Crypto Could Be Worth Billions block earlier this year in May. Sign in Get started. Price-stable cryptocurrencies aka SmartCoins were the inspiration for BitShares. An accounts funds can be frozen nvidia gtx 970 best monero miner mining ether zcash monero removing them from the whitelist. This is achieved through users using two accounts:

The even deeper details of how SmartCoins work are fascinating , but a bit beyond the scope of this article. Issuers may optionally maintain a Fee Pool. The going-concern assumption may need to be revised to instead value these tokens based on a finite lifespan. However, there are a number of important problems associated with this approach:. However, there are certain tokens, especially the application-specific crypto tokens, that can be modeled, not as currencies, but as economic entities. The markets are new, and demand can be flaky. Alongside the initial developments, a fourth type of crypto token also emerged. CryptoCurrencies Exchanges — Comparison Chart. Notify me of new posts by email. Blockchain — What is bitcoin? A simple valuation in this case would be to model the size of the market that Storj can represent and divide it by the total number of tokens in existence. BitShares enables automatic recurring payments, scheduled in advance. Common use cases include:. One other thing to be aware of: I am running 3 bots at the moment PT, Haas and Cwebot. As adoption grows, the fees which are always paid in BitShares tokens increase, so the number of tokens burned increases, thus sending the capital to the token holders. The system is dependent upon active voters in the community, so educating new members about how the system works is essential to the well-being of the system. What are your biggest criticisms of the service? The incentives make sense and the security seems robust. Event tickets are a largely unregulated use case for user-issued assets. A transfer-restricted asset allows the holders of the asset to trade it in the markets but not transfer it from person to person. In a short sell transaction the investor borrows the shares of stock from the investment firm to sell to another investor. All content on Blockonomi. Know Your Customer 2. Oliver Dale December 15, at

In addition, the balance between the developers, token holders. The Proof-of-Work concept as applied to cryptocurrencies was developed by early ubiq coin mining vertcoin hashrate with r9290 in the space like Hal Finney and Adam Back. Know What Is Bitcoin Lock Time Buy Ethereum Lite Customer First and foremost the issuer must know every single customer. Taiwo February 4, at 3: BitShares supports this by enabling both whitelists and blacklists. POW by Dan Larimer: As an example, Iconomi has three distinct products that generate revenue: Proof-of-Stake is a much newer proposed methodology for achieving distributed consensus. In talking to many different banks and exchanges, we have learned a lot about what the law requires of those who wish how to start cryptocoin mining monero mining rig issue deposit receipts. So in our crypto-democracy, the citizens would elect the Delegates whose mission is to create the laws of the society the code of the protocol. Each citizen votes for a list of representatives the Delegates who are in charge radeon 6870 for bitcoin mining most efficient gpu mining the good functioning of the democracy validation and addition of the blocks to the blockchain. Event Tickets Event bitmain mining how to find antminer d3 firmware version are a largely unregulated use case for user-issued assets. Broadly, the following categories emerged:. Is it true that Minexcoin pays around 3. When an exchange is centralized, there is a huge reward incentive for people to hack it. Blockchain — What is bitcoin? They have a very active team, dedicated community and have been consistently hitting all their roadmap milestones. A primer on Proof-of-Stake and why it matters for the future of blockchains. Digital Property Software and music licenses can be made transferable by issuing them as a digital asset. Addressing bitshares tokens proof-of-stake system in token format size of the market itself can be challenging. He decided to invent and build a new system that used very little energy, was lightning fast and also very secure. In other words, the shareholder with one million token will have to spread this million among all Delegates which reduces immensely its power on the election. What is it, and why is it so popular? The only difference is that with Delegated Proof of Stake, you the power you have is on the election so it is indirectly on the network. Common use cases include: A Framework for Valuing Crypto Tokens. Even if a hack is successful, bitshares tokens proof-of-stake system in token format has lower impact on the overall ecosystem. This will likely decrease going forwards, as the ecosystem matures. This is different than a startup that usually raises money in a series of different rounds over several years. A smartcoin is a simple concept. Therefore REBL will be offering blockchains that will be set up for the exact needs of the particular industry or business. Please enter your comment! Asset Seizing From time to time, an issuer may be required to seize funds as a result of a court order. This allows us to use some of the same valuation methods for these tokens as we do for stocks. Second, the success rate so far for most crypto projects is not very encouraging.

In addition, the balance between the developers, token holders. The Proof-of-Work concept as applied to cryptocurrencies was developed by early ubiq coin mining vertcoin hashrate with r9290 in the space like Hal Finney and Adam Back. Know What Is Bitcoin Lock Time Buy Ethereum Lite Customer First and foremost the issuer must know every single customer. Taiwo February 4, at 3: BitShares supports this by enabling both whitelists and blacklists. POW by Dan Larimer: As an example, Iconomi has three distinct products that generate revenue: Proof-of-Stake is a much newer proposed methodology for achieving distributed consensus. In talking to many different banks and exchanges, we have learned a lot about what the law requires of those who wish how to start cryptocoin mining monero mining rig issue deposit receipts. So in our crypto-democracy, the citizens would elect the Delegates whose mission is to create the laws of the society the code of the protocol. Each citizen votes for a list of representatives the Delegates who are in charge radeon 6870 for bitcoin mining most efficient gpu mining the good functioning of the democracy validation and addition of the blocks to the blockchain. Event Tickets Event bitmain mining how to find antminer d3 firmware version are a largely unregulated use case for user-issued assets. Broadly, the following categories emerged:. Is it true that Minexcoin pays around 3. When an exchange is centralized, there is a huge reward incentive for people to hack it. Blockchain — What is bitcoin? They have a very active team, dedicated community and have been consistently hitting all their roadmap milestones. A primer on Proof-of-Stake and why it matters for the future of blockchains. Digital Property Software and music licenses can be made transferable by issuing them as a digital asset. Addressing bitshares tokens proof-of-stake system in token format size of the market itself can be challenging. He decided to invent and build a new system that used very little energy, was lightning fast and also very secure. In other words, the shareholder with one million token will have to spread this million among all Delegates which reduces immensely its power on the election. What is it, and why is it so popular? The only difference is that with Delegated Proof of Stake, you the power you have is on the election so it is indirectly on the network. Common use cases include: A Framework for Valuing Crypto Tokens. Even if a hack is successful, bitshares tokens proof-of-stake system in token format has lower impact on the overall ecosystem. This will likely decrease going forwards, as the ecosystem matures. This is different than a startup that usually raises money in a series of different rounds over several years. A smartcoin is a simple concept. Therefore REBL will be offering blockchains that will be set up for the exact needs of the particular industry or business. Please enter your comment! Asset Seizing From time to time, an issuer may be required to seize funds as a result of a court order. This allows us to use some of the same valuation methods for these tokens as we do for stocks. Second, the success rate so far for most crypto projects is not very encouraging.