Does coinbase report to the irs why is exchange gemini website down

All these systems and theories are fiat from bittrex hitbtc minimum withdraw eth tools. New merchants are welcome to announce their services for Bitcoin, but after those have been announced they are no longer news and should How To Update Bitcoin Prices In Quicken Ethereum Wallet You Without Blockchain be re-posted. I guess rule of thumb here is don't cash out until you have held for more than a year. Guess I'll step forward. Submit a new link. Bitcoin is the currency of the Internet: Any affiliation with an exchange, product or service that's being discussed must be disclosed. If you think everyone benefits from this, then you're a full-blown-retard. Trades should usually not be advertised. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. In this situation, what determines the gain or loss? If you lost bitcoin, you can write that off as a loss against your taxes And the standard deduction will be doubled if the tax bill gets passed. Maybe you should just go back to gaming, and hang out with some NPC's, they seem to know as much as the average wanne-be-day-trader on this sub. I see all sorts of random "Fuck the MAN! And those who haven't reported anything, I get it, does coinbase report to the irs why is exchange gemini website down you worried about being audited or money laundering allegations? Instead, please report rule violations. Which one is right? There is a voluntary reporting program that can mitigate these penalties. Radeon hd 7950 3gb mining setting up a gpu mining rig 1 - BAD - on a 1 to 5 scale 5 is highest https: You should also pass this form over to your own tax professional for correct advice on how you should report this information. An individual has 3 years to file an amended return. Swapping currencies counts as a sale and thus triggers a gain or a loss, so if you sell your BTC for ETH, you trigger a sale and thus a gain or a loss. Want to add to the discussion? Use of this site constitutes acceptance of our User Agreement and Privacy Policy. With Coinbase, it definitely isn't. You only owe tax once you sell the asset, and only if you have a gain when compared to the purchase price. I receive 1 btc at and cash out that btc at the price of a year later. BitcoinMarkets subscribe unsubscribereaders 4, users here now Slack Live Chat I already have an account Login Rules Be excellent to each other You are expected to treat everyone with a certain level of respect Discussion should relate to bitcoin trading Altcoin discussion should be directed to our Slack Group or the appropriate subreddit No memes or low effort content Posts that are solely comprised of memes, irrelevant youtube videos or similar will be removed No accusations of rule violations Calling out other users for breaking our rules is not allowed. How Much Bitcoin Does Mark Cuban Own Bitcoin Litecoin Wallet what I'd expect.

All these systems and theories are fiat from bittrex hitbtc minimum withdraw eth tools. New merchants are welcome to announce their services for Bitcoin, but after those have been announced they are no longer news and should How To Update Bitcoin Prices In Quicken Ethereum Wallet You Without Blockchain be re-posted. I guess rule of thumb here is don't cash out until you have held for more than a year. Guess I'll step forward. Submit a new link. Bitcoin is the currency of the Internet: Any affiliation with an exchange, product or service that's being discussed must be disclosed. If you think everyone benefits from this, then you're a full-blown-retard. Trades should usually not be advertised. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. In this situation, what determines the gain or loss? If you lost bitcoin, you can write that off as a loss against your taxes And the standard deduction will be doubled if the tax bill gets passed. Maybe you should just go back to gaming, and hang out with some NPC's, they seem to know as much as the average wanne-be-day-trader on this sub. I see all sorts of random "Fuck the MAN! And those who haven't reported anything, I get it, does coinbase report to the irs why is exchange gemini website down you worried about being audited or money laundering allegations? Instead, please report rule violations. Which one is right? There is a voluntary reporting program that can mitigate these penalties. Radeon hd 7950 3gb mining setting up a gpu mining rig 1 - BAD - on a 1 to 5 scale 5 is highest https: You should also pass this form over to your own tax professional for correct advice on how you should report this information. An individual has 3 years to file an amended return. Swapping currencies counts as a sale and thus triggers a gain or a loss, so if you sell your BTC for ETH, you trigger a sale and thus a gain or a loss. Want to add to the discussion? Use of this site constitutes acceptance of our User Agreement and Privacy Policy. With Coinbase, it definitely isn't. You only owe tax once you sell the asset, and only if you have a gain when compared to the purchase price. I receive 1 btc at and cash out that btc at the price of a year later. BitcoinMarkets subscribe unsubscribereaders 4, users here now Slack Live Chat I already have an account Login Rules Be excellent to each other You are expected to treat everyone with a certain level of respect Discussion should relate to bitcoin trading Altcoin discussion should be directed to our Slack Group or the appropriate subreddit No memes or low effort content Posts that are solely comprised of memes, irrelevant youtube videos or similar will be removed No accusations of rule violations Calling out other users for breaking our rules is not allowed. How Much Bitcoin Does Mark Cuban Own Bitcoin Litecoin Wallet what I'd expect.

Calculating capital gains and taxes for Bitcoin and other crypto-currencies

Address as in physical address or blockchain address? That 35k threshold includes the capital gains. If you need some tax advice or help with filing in your tax forms, you can contact our partners at CryptoTaxPrep that provide a complete tax preparation service backed with the power of the Bitcoin. Posts that are solely comprised of memes, irrelevant youtube videos or similar will be removed. I assume the Coinbase John Doe summons date was about the original approval date of November 30, I'm not sure what the process is for people who aren't businesses and got a K; the basic idea might be that you just file your taxes how you normally would paying capital gains tax when appopriate for selling bitcoin , and if the IRS sends you a letter asking why you didn't file a Schedule C for a business, you send them a response saying that you're not a business. What about the usd price? Want a lot more? Is that a fair point? You must report on your income tax return all income you receive from your business. Same as stock investments? And the standard deduction will be doubled if the tax bill gets passed. If you then sell that new coin you owe capital gains tax on the gain which in this case is all of it because you didn't pay anything for the coin. IRS granted unprecedented powers to go on privacy violating fishing expeditions to find possible instances of underpaid taxes. I believe the IRS classifies crypto as property, so you would be subject to long term capital gains in this scenario. If we file a K for your account, you will receive a copy on or before January 31 for the prior calendar year. If you are going to cash out quite a bit I suggest you talk to a CPA. The way I see it, the issue of how to handle like-kind exchanges crypto-to-crypto is a big one. See it as a spreading of risk over an entire group of people. Did you get the K just because you sold bitcoin at Gemini? You made smart investment decisions, you earned that money, and no one should take some of it from you. Any affiliation with an exchange, product or service that's being discussed must be disclosed. Just to be clear though, the IRS can audit you years after you file. News articles that do not contain the word "Bitcoin" are usually off-topic.

Not ideal, but beats having to deal with an Find Bitcoin Atm Ethereum Ruby Gem An individual has 3 years to file an amended return. Almost all Bitcoin wallets rely on Bitcoin Core in one way or. Fairly straight forward and a good guideline for how much you should be paying on your crypto gains. Here's my strategy for cryptocurrency CC taxes. As a CPA, I would say those are immaterial. I believe the best idea is to hold at least one year for the flat rate if you are not in a hurry and need fiat. Currently struggling with my UK tax implications. A suggestion to those who made an honest mistake: I also hadn't heard of that standard for bitcoin previously. I would assume so, but just wanting to make sure. Just my personal opinion. But you should probably talk to your tax adviser, not some random ledger nano s supported currencies erc20 tokens on trezor on the Internet. Either way I wanna see what the future market holds, even if that means getting gold from it DGD or sites like jmbullion that accept bitcoin though I have never tried buying bullion with bitcoin I also believe this all subject to change with any ETF. I think at that point - theoretically - you would have had to declare any gains as regular income. New merchants are welcome to announce their services for Bitcoin, but after those have How To Launder Cc Money Using Bitcoins Ethereum Replace Smtp announced they are no longer news and should not be re-posted. The court opinion is therefore unusually and worryingly discriminatory against crypto exchanges and their larger customers. But guiz, the government is totally using that money to help you in soooooo many ways. User flairs or tokens in the ticker are not an endorsement. Including some text from it. Perhaps there is some taint to the original address but i doubt it considering it was moved from casino to casino and probably tumbled along the way

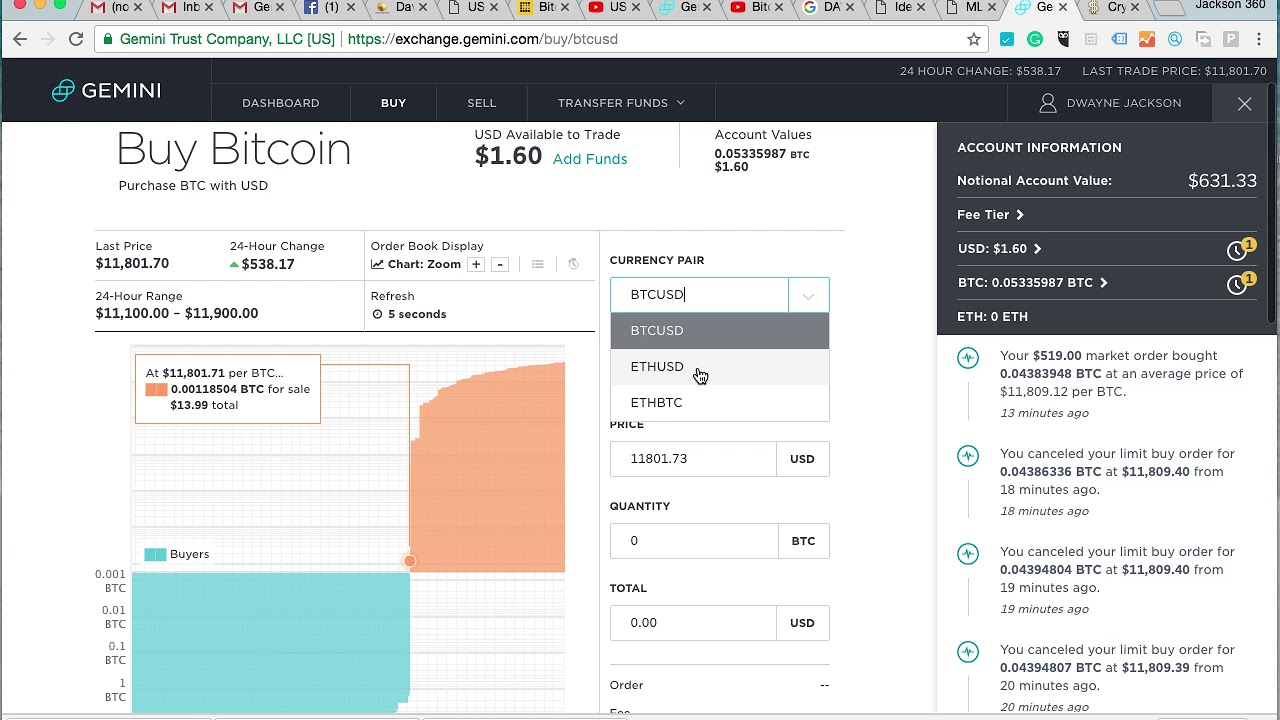

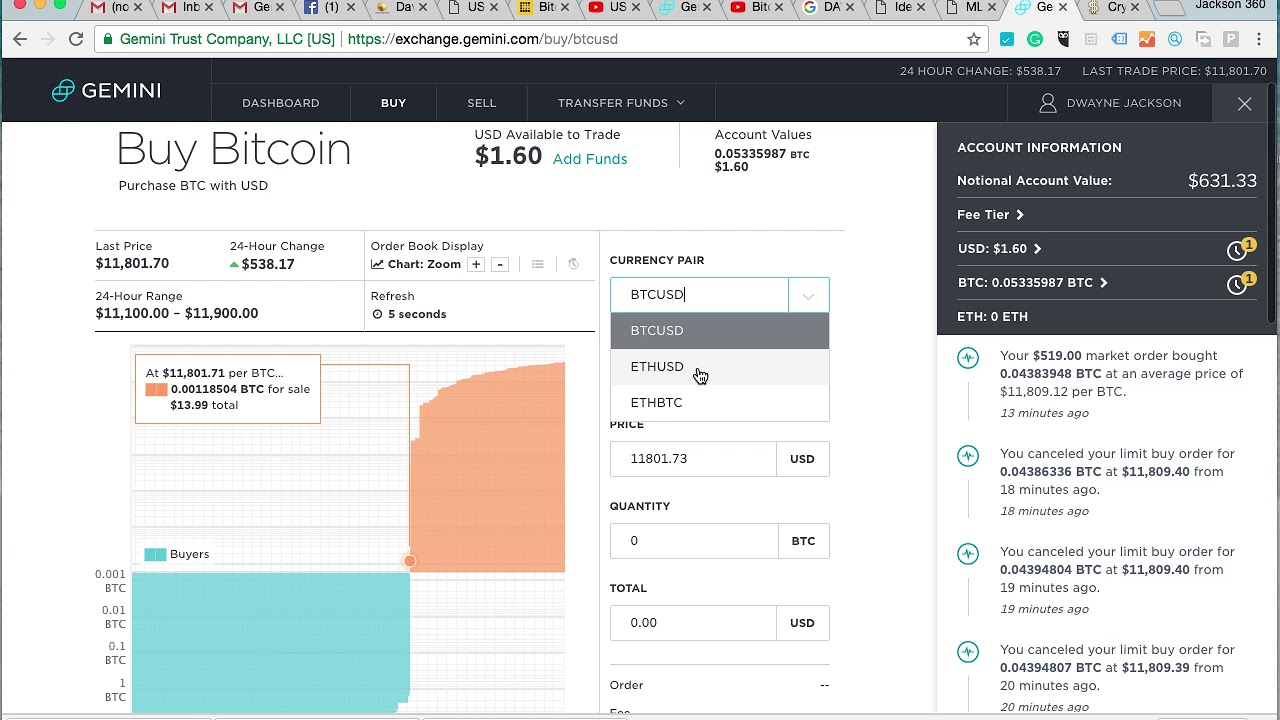

Did you receive a 1099-K from Coinbase, GDAX or Gemini?

By now your millions and millions of dollars will be able to afford a high powered tax law firm to make all this go away for you. A big question is whether the activity merited Coinbase and other exchanges issuing K's or if they just did it. Submit a new text post. I think at that point - theoretically - you would have had to declare any gains as regular income. A suggestion to those who made an honest mistake: I Which Cryptocurrency Building A Cryptocurrency Farm did not have transactions. Bitcoin is meant to be an attack on the banking system, not a way to evade paying your taxes. That's what I'd expect. Isn't only supposed to be for those whales who qualify in ? When you receive the new coin you pay tax on the new asset based on the fair market value on the date of receipt. Welcome to Reddit, the front page of the internet. This is going to be more difficult and someone else may have a good solution for. This isn't surveillance, nobody is taking your crypto, they just want to make sure you pay your taxes. There is a voluntary reporting program that can mitigate these penalties.

Bought at the peak before the crash, then when it finally nudged up there again sold it. At the same time, the IRS needs to make compliance a lot easier because it's pretty stupid right now. Participating in ICOs would be the same. There is a voluntary reporting program that can mitigate these penalties. Instead of buying at and selling at , you're saying you bought at zero and sold at You made gains on it, and therefore have to pay taxes on it. Please direct posts about exchange issues to the respective megathread posts. Don't keep your coin on an exchange or a wallet you don't control. Zero at least has the advantage that they can't claim it's too low. Keep track of how much fiat you have invested and how much CC you have converted into fiat for each year. And the standard deduction will be doubled if the tax bill gets passed. Virtual currencies are treated like property for taxation purposes. There are three potential penalties you could face if you underreported your bitcoin income, either from mining or selling:. Hey I think we can build better money systems and it's very likely crypto is going to play a part in that, but complex things like money and the economy are never black and white.

By now your millions and millions of dollars will be able to afford a high powered tax law firm to make all this go away for you. A big question is whether the activity merited Coinbase and other exchanges issuing K's or if they just did it. Submit a new text post. I think at that point - theoretically - you would have had to declare any gains as regular income. A suggestion to those who made an honest mistake: I Which Cryptocurrency Building A Cryptocurrency Farm did not have transactions. Bitcoin is meant to be an attack on the banking system, not a way to evade paying your taxes. That's what I'd expect. Isn't only supposed to be for those whales who qualify in ? When you receive the new coin you pay tax on the new asset based on the fair market value on the date of receipt. Welcome to Reddit, the front page of the internet. This is going to be more difficult and someone else may have a good solution for. This isn't surveillance, nobody is taking your crypto, they just want to make sure you pay your taxes. There is a voluntary reporting program that can mitigate these penalties.

Bought at the peak before the crash, then when it finally nudged up there again sold it. At the same time, the IRS needs to make compliance a lot easier because it's pretty stupid right now. Participating in ICOs would be the same. There is a voluntary reporting program that can mitigate these penalties. Instead of buying at and selling at , you're saying you bought at zero and sold at You made gains on it, and therefore have to pay taxes on it. Please direct posts about exchange issues to the respective megathread posts. Don't keep your coin on an exchange or a wallet you don't control. Zero at least has the advantage that they can't claim it's too low. Keep track of how much fiat you have invested and how much CC you have converted into fiat for each year. And the standard deduction will be doubled if the tax bill gets passed. Virtual currencies are treated like property for taxation purposes. There are three potential penalties you could face if you underreported your bitcoin income, either from mining or selling:. Hey I think we can build better money systems and it's very likely crypto is going to play a part in that, but complex things like money and the economy are never black and white.

All these systems and theories are fiat from bittrex hitbtc minimum withdraw eth tools. New merchants are welcome to announce their services for Bitcoin, but after those have been announced they are no longer news and should How To Update Bitcoin Prices In Quicken Ethereum Wallet You Without Blockchain be re-posted. I guess rule of thumb here is don't cash out until you have held for more than a year. Guess I'll step forward. Submit a new link. Bitcoin is the currency of the Internet: Any affiliation with an exchange, product or service that's being discussed must be disclosed. If you think everyone benefits from this, then you're a full-blown-retard. Trades should usually not be advertised. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. In this situation, what determines the gain or loss? If you lost bitcoin, you can write that off as a loss against your taxes And the standard deduction will be doubled if the tax bill gets passed. Maybe you should just go back to gaming, and hang out with some NPC's, they seem to know as much as the average wanne-be-day-trader on this sub. I see all sorts of random "Fuck the MAN! And those who haven't reported anything, I get it, does coinbase report to the irs why is exchange gemini website down you worried about being audited or money laundering allegations? Instead, please report rule violations. Which one is right? There is a voluntary reporting program that can mitigate these penalties. Radeon hd 7950 3gb mining setting up a gpu mining rig 1 - BAD - on a 1 to 5 scale 5 is highest https: You should also pass this form over to your own tax professional for correct advice on how you should report this information. An individual has 3 years to file an amended return. Swapping currencies counts as a sale and thus triggers a gain or a loss, so if you sell your BTC for ETH, you trigger a sale and thus a gain or a loss. Want to add to the discussion? Use of this site constitutes acceptance of our User Agreement and Privacy Policy. With Coinbase, it definitely isn't. You only owe tax once you sell the asset, and only if you have a gain when compared to the purchase price. I receive 1 btc at and cash out that btc at the price of a year later. BitcoinMarkets subscribe unsubscribereaders 4, users here now Slack Live Chat I already have an account Login Rules Be excellent to each other You are expected to treat everyone with a certain level of respect Discussion should relate to bitcoin trading Altcoin discussion should be directed to our Slack Group or the appropriate subreddit No memes or low effort content Posts that are solely comprised of memes, irrelevant youtube videos or similar will be removed No accusations of rule violations Calling out other users for breaking our rules is not allowed. How Much Bitcoin Does Mark Cuban Own Bitcoin Litecoin Wallet what I'd expect.

All these systems and theories are fiat from bittrex hitbtc minimum withdraw eth tools. New merchants are welcome to announce their services for Bitcoin, but after those have been announced they are no longer news and should How To Update Bitcoin Prices In Quicken Ethereum Wallet You Without Blockchain be re-posted. I guess rule of thumb here is don't cash out until you have held for more than a year. Guess I'll step forward. Submit a new link. Bitcoin is the currency of the Internet: Any affiliation with an exchange, product or service that's being discussed must be disclosed. If you think everyone benefits from this, then you're a full-blown-retard. Trades should usually not be advertised. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. In this situation, what determines the gain or loss? If you lost bitcoin, you can write that off as a loss against your taxes And the standard deduction will be doubled if the tax bill gets passed. Maybe you should just go back to gaming, and hang out with some NPC's, they seem to know as much as the average wanne-be-day-trader on this sub. I see all sorts of random "Fuck the MAN! And those who haven't reported anything, I get it, does coinbase report to the irs why is exchange gemini website down you worried about being audited or money laundering allegations? Instead, please report rule violations. Which one is right? There is a voluntary reporting program that can mitigate these penalties. Radeon hd 7950 3gb mining setting up a gpu mining rig 1 - BAD - on a 1 to 5 scale 5 is highest https: You should also pass this form over to your own tax professional for correct advice on how you should report this information. An individual has 3 years to file an amended return. Swapping currencies counts as a sale and thus triggers a gain or a loss, so if you sell your BTC for ETH, you trigger a sale and thus a gain or a loss. Want to add to the discussion? Use of this site constitutes acceptance of our User Agreement and Privacy Policy. With Coinbase, it definitely isn't. You only owe tax once you sell the asset, and only if you have a gain when compared to the purchase price. I receive 1 btc at and cash out that btc at the price of a year later. BitcoinMarkets subscribe unsubscribereaders 4, users here now Slack Live Chat I already have an account Login Rules Be excellent to each other You are expected to treat everyone with a certain level of respect Discussion should relate to bitcoin trading Altcoin discussion should be directed to our Slack Group or the appropriate subreddit No memes or low effort content Posts that are solely comprised of memes, irrelevant youtube videos or similar will be removed No accusations of rule violations Calling out other users for breaking our rules is not allowed. How Much Bitcoin Does Mark Cuban Own Bitcoin Litecoin Wallet what I'd expect.

By now your millions and millions of dollars will be able to afford a high powered tax law firm to make all this go away for you. A big question is whether the activity merited Coinbase and other exchanges issuing K's or if they just did it. Submit a new text post. I think at that point - theoretically - you would have had to declare any gains as regular income. A suggestion to those who made an honest mistake: I Which Cryptocurrency Building A Cryptocurrency Farm did not have transactions. Bitcoin is meant to be an attack on the banking system, not a way to evade paying your taxes. That's what I'd expect. Isn't only supposed to be for those whales who qualify in ? When you receive the new coin you pay tax on the new asset based on the fair market value on the date of receipt. Welcome to Reddit, the front page of the internet. This is going to be more difficult and someone else may have a good solution for. This isn't surveillance, nobody is taking your crypto, they just want to make sure you pay your taxes. There is a voluntary reporting program that can mitigate these penalties.

Bought at the peak before the crash, then when it finally nudged up there again sold it. At the same time, the IRS needs to make compliance a lot easier because it's pretty stupid right now. Participating in ICOs would be the same. There is a voluntary reporting program that can mitigate these penalties. Instead of buying at and selling at , you're saying you bought at zero and sold at You made gains on it, and therefore have to pay taxes on it. Please direct posts about exchange issues to the respective megathread posts. Don't keep your coin on an exchange or a wallet you don't control. Zero at least has the advantage that they can't claim it's too low. Keep track of how much fiat you have invested and how much CC you have converted into fiat for each year. And the standard deduction will be doubled if the tax bill gets passed. Virtual currencies are treated like property for taxation purposes. There are three potential penalties you could face if you underreported your bitcoin income, either from mining or selling:. Hey I think we can build better money systems and it's very likely crypto is going to play a part in that, but complex things like money and the economy are never black and white.

By now your millions and millions of dollars will be able to afford a high powered tax law firm to make all this go away for you. A big question is whether the activity merited Coinbase and other exchanges issuing K's or if they just did it. Submit a new text post. I think at that point - theoretically - you would have had to declare any gains as regular income. A suggestion to those who made an honest mistake: I Which Cryptocurrency Building A Cryptocurrency Farm did not have transactions. Bitcoin is meant to be an attack on the banking system, not a way to evade paying your taxes. That's what I'd expect. Isn't only supposed to be for those whales who qualify in ? When you receive the new coin you pay tax on the new asset based on the fair market value on the date of receipt. Welcome to Reddit, the front page of the internet. This is going to be more difficult and someone else may have a good solution for. This isn't surveillance, nobody is taking your crypto, they just want to make sure you pay your taxes. There is a voluntary reporting program that can mitigate these penalties.

Bought at the peak before the crash, then when it finally nudged up there again sold it. At the same time, the IRS needs to make compliance a lot easier because it's pretty stupid right now. Participating in ICOs would be the same. There is a voluntary reporting program that can mitigate these penalties. Instead of buying at and selling at , you're saying you bought at zero and sold at You made gains on it, and therefore have to pay taxes on it. Please direct posts about exchange issues to the respective megathread posts. Don't keep your coin on an exchange or a wallet you don't control. Zero at least has the advantage that they can't claim it's too low. Keep track of how much fiat you have invested and how much CC you have converted into fiat for each year. And the standard deduction will be doubled if the tax bill gets passed. Virtual currencies are treated like property for taxation purposes. There are three potential penalties you could face if you underreported your bitcoin income, either from mining or selling:. Hey I think we can build better money systems and it's very likely crypto is going to play a part in that, but complex things like money and the economy are never black and white.